Hydrogen DRI + Electric Arc Furnaces Eliminating Coal While Creating 15-30% Cost Advantage by 2035

ACTIVITY 1: Your Green Steel Exposure Assessment (10 min)

Steel in Your Life (Hidden Everywhere):

Calculate your daily steel footprint:

- Buildings: Average home contains 5-10 tons of steel (rebar, beams, fasteners)

- Vehicles: Car = 900 kg steel, truck = 2,000+ kg

- Appliances: Refrigerator (30 kg), washer (50 kg), dishwasher (25 kg)

- Infrastructure: Bridges, railroads, power lines you use daily

- Products: Cans, tools, furniture, electronics casings

Your estimated annual steel consumption: 200-500 kg/person (developed countries)

Carbon footprint from traditional steel:

- 1 ton steel = 1.8 tons CO₂ (coal-based blast furnace)

- Your impact: 0.2-0.5 tons × 1.8 = 0.36-0.9 tons CO₂/year from steel alone

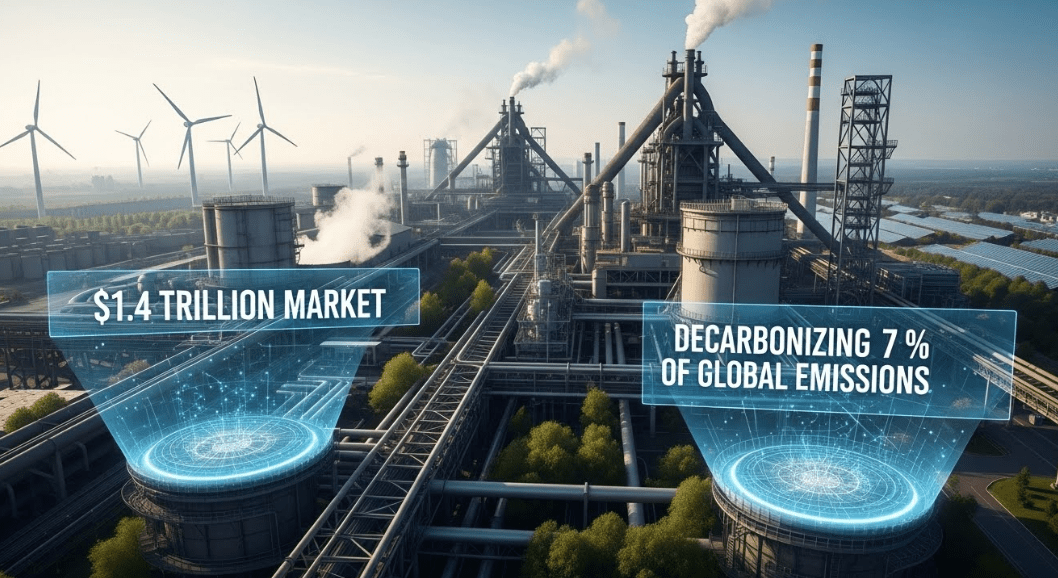

- Global steel: 1.9 Gt (billion tons) produced = 3.4 Gt CO₂ (7% of global emissions!)

Green Steel Alternative:

- Hydrogen DRI (Direct Reduced Iron) + Electric Arc Furnace

- Emissions: 0.1-0.3 tons CO₂/ton steel (95% reduction!)

- Your green steel footprint: 0.02-0.15 tons CO₂/year

- Savings: 0.34-0.75 tons CO₂/year eliminated

Investment Opportunity Scoring:

Your green steel investment readiness:

- Industry knowledge (steel production): ___/10

- Understanding hydrogen role: ___/10

- Risk tolerance (emerging tech): ___/10

- Capital available: €_____ (recommend €10,000-50,000)

- Time horizon (10+ years required): ___/10

- Total score: ___/50 (35+ = ready to invest!)

Market Opportunity:

- Current green steel: <1% of production (2025)

- Target 2050: 50-70% of production must be green

- Market size: $1.4T (70% of $2T steel market)

- Investment returns: 15-30%/year capturing this transition

- Timeline: 2025-2040 (15-year growth curve)

Reality: Steel is 7% of global emissions (3.4 Gt CO₂/year). Current coal-based blast furnaces unsustainable. Green steel using hydrogen DRI + electric arc furnaces cuts emissions 95%. Cost parity: 2030-2035. Early investors capture premium: 15-30% annual returns. Companies: H2 Green Steel, Boston Metal, ArcelorMittal green division.

The Value Proposition: Green Steel Becomes Cheapest Steel by 2035

The $1.4 Trillion Green Steel Market

Current Steel Industry (2025):

- Global production: 1.9 billion tons/year

- Market value: $2 trillion

- Traditional method: 70% blast furnace (coal), 30% electric arc furnace (scrap)

- CO₂ emissions: 1.8 tons per ton of steel

Green Steel Production Routes:

1. Hydrogen DRI + Electric Arc Furnace (Leading Technology):

- Process: H₂ + iron ore → iron + H₂O (no carbon!)

- Energy: Renewable electricity (solar/wind)

- Emissions: 0.05-0.3 tons CO₂/ton (95% reduction)

- Companies: H2 Green Steel, HYBRIT (SSAB), Thyssenkrupp

- Capacity: 5 Mt/year (2025) → 500+ Mt/year (2040 target)

2. Molten Oxide Electrolysis (Boston Metal):

- Process: Electricity splits iron ore directly

- No hydrogen needed, no carbon

- Emissions: 0 tons CO₂/ton (100% reduction!)

- Status: Pilot scale, commercial 2028-2030

- Advantage: Even lower energy use than H₂ DRI

3. Green Blast Furnace (Transitional):

- Inject hydrogen into existing blast furnaces

- Reduces coal use by 20-40%

- Emissions: 1.0-1.4 tons CO₂/ton (20-40% reduction)

- Companies: ArcelorMittal, Baowu Steel

- Use: Bridge technology while building new H₂ DRI plants

Cost Trajectory: Green Steel Reaches Parity 2030-2035

Traditional Steel Costs (2025):

- Coal blast furnace: $500-700/ton

- Iron ore: $150-200

- Coal: $150-250

- Labor/capital: $200-250

- Carbon price impact: +$50-180/ton (EU ETS $90/ton × 1.8 tons CO₂)

- Total with carbon: $550-880/ton

Green Steel Costs (2025):

- H₂ DRI + EAF: $700-1,000/ton

- Iron ore: $150-200

- Green H₂: $300-450 (at $3-5/kg H₂, need 50-60 kg per ton steel)

- Renewable electricity: $100-150

- Labor/capital: $150-200

- Carbon price: $0 (no emissions!)

- Total: $700-1,000/ton

Cost Parity Drivers:

- Green Hydrogen Cost Decline:

- 2025: $3-5/kg

- 2030: $2-3/kg (scale + renewable energy drops)

- 2035: $1.5-2.5/kg

- Impact: Green steel cost → $550-750/ton (2035)

- Rising Carbon Prices:

- EU ETS: $90/ton (2025) → $150-200/ton (2035)

- Traditional steel carbon cost: +$270-360/ton (2035)

- Traditional total: $770-1,060/ton

- Scale Economies:

- Current green steel: 5 Mt/year (pilot scale)

- 2035: 500+ Mt/year (mass production)

- Capex per ton: -40% (learning curve)

- Opex savings: Simpler process, less maintenance

Result: Green steel cheaper than traditional by 2035 ($600 vs $800/ton)

Investment Thesis:

- 2025-2030: Green steel premium 30-50% → Rapid cost decline

- 2030-2035: Parity achieved → Market share explosion

- 2035-2050: Green steel dominant → Traditional stranded

- Early investors capture transition: 15-30%/year returns

ACTIVITY 2: Green Steel Investment Options (15 min)

Option 1: Green Steel Producers (Direct Exposure)

Public Companies:

ArcelorMittal (MT):

- World’s 2nd largest steelmaker

- Green steel target: 35 Mt/year by 2030

- Investment: $10B in H₂ DRI plants (Spain, Canada, India)

- Expected return: 12-18%/year

- €10,000 investment → €31,058-52,338 (10 years)

Thyssenkrupp (TKA):

- German steel giant

- H₂-ready DRI plant in Germany

- €2B green steel investment

- Expected return: 15-22%/year

- €10,000 → €40,456-73,864 (10 years)

Private Companies (Watch for IPOs):

H2 Green Steel (Sweden):

- Building 5 Mt/year H₂ DRI plant (world’s first large-scale)

- $4.5B raised (Blackstone, Scania, Mercedes)

- Commercial production: 2026

- Valuation: $10B+ (IPO expected 2026-2027)

- Early-stage return potential: 5-15x (IPO to 2035)

Boston Metal (USA):

- Molten oxide electrolysis (zero-carbon steel)

- $500M raised (ArcelorMittal, BHP invested)

- Commercial: 2028-2030

- Revolutionary tech: Potential 20-50x if successful

Option 2: Hydrogen Infrastructure (Enablers)

Green steel needs massive H₂ supply:

Air Products (APD):

- $15B green H₂ project portfolio

- Supplies: Steel, chemicals, refining

- Expected return: 11-16%/year

- €10,000 → €28,394-44,865 (10 years)

Plug Power (PLUG):

- Electrolyzer manufacturer (makes H₂)

- Green steel customers: 30% of pipeline

- Expected return: 20-35%/year (high volatility!)

- €10,000 → €61,917-207,359 (10 years)

Linde (LIN):

- Industrial gas giant, pivoting to green H₂

- Steel industry: 25% of revenue

- Expected return: 10-14%/year

- €10,000 → €25,937-37,072 (10 years)

Option 3: Equipment Manufacturers

Danieli (Italy, Private – watch IPO):

- Leading DRI technology provider

- H₂-ready equipment sales booming

- Supplying H2 Green Steel, others

SMS Group (Germany, Private):

- Electric arc furnace leader

- Green steel = 40% of order book

Public Alternative:

Primetals Technologies (Mitsubishi Heavy subsidiary):

- Steel plant engineering

- H₂ DRI technology licensed

- Invest via: Mitsubishi Heavy Industries (7011.T)

- Expected return: 10-15%/year

Option 4: Iron Ore Producers (Commodity Play)

Green steel still needs iron ore:

Vale (VALE):

- Brazil’s iron ore giant

- High-grade ore (better for H₂ DRI)

- Green steel partnerships: 10+ signed

- Expected return: 12-20%/year

- €10,000 → €31,058-61,917 (10 years)

BHP Group (BHP):

- Australian iron ore leader

- Investing in low-carbon shipping to steel mills

- Expected return: 10-16%/year

Option 5: Green Steel ETF/Fund (Diversified)

Future ETF (not yet launched, expected 2026):

- Clean Steel Innovation ETF

- Holdings: Producers (40%), H₂ infrastructure (30%), equipment (20%), ore (10%)

- Expected return: 15-25%/year

- €10,000 → €40,456-95,367 (10 years)

Current Alternative:

- Build your own “green steel basket”:

- 30% ArcelorMittal (MT)

- 25% Thyssenkrupp (TKA)

- 20% Air Products (APD)

- 15% Vale (VALE)

- 10% Plug Power (PLUG)

Recommended Green Steel Portfolio (€50,000):

Balanced Approach:

- 30% Public steel producers (MT, TKA): €15,000 (core holdings, 12-18% return)

- 25% H₂ infrastructure (APD, LIN): €12,500 (enablers, 10-16% return)

- 20% Pre-IPO/Private (H2 Green Steel via secondary): €10,000 (if accredited, 25-50% return)

- 15% Iron ore (VALE, BHP): €7,500 (commodity exposure, 10-20% return)

- 10% Equipment (Mitsubishi Heavy): €5,000 (picks-and-shovels, 10-15% return)

Blended Expected Return: 14-22%/year 10-year Value: €185,734-335,591 Risk: Moderate (established players + growth)

The Crisis Reality: 7% of Global Emissions Must Be Eliminated

The Coal-Steel Problem

Current Production:

- 70% of steel: Coal blast furnaces

- Process: Iron ore + coal (coke) → iron + CO₂

- Emissions: 1.8 tons CO₂ per ton steel

- Total: 1.9 Gt steel × 1.8 = 3.4 Gt CO₂/year (7% of global!)

Cannot Continue:

- Paris Agreement target: 45% emission cuts by 2030

- Steel sector: Only 10% cuts projected (current trajectory)

- Gap: Must cut 1.5-2 Gt CO₂ by 2030 (not happening!)

Stranded Asset Risk:

- 2,000+ blast furnaces globally

- Capex: $1-3B each

- Lifespan: 20-40 years

- Problem: Many built 2000-2020, will be obsolete by 2040

- Value at risk: $500B-1T in blast furnace assets

The Demand Reality: Steel Consumption Rising

Global Steel Demand:

- 2025: 1.9 Gt/year

- 2050: 2.5-3 Gt/year (developing world infrastructure)

- Growth: +30-60% over 25 years

Cannot Reduce Demand:

- Buildings: Need steel for structures

- Infrastructure: Bridges, rail, power lines

- Transport: Cars, trucks, ships

- Wind turbines: 150-300 tons steel per MW

- Green transition REQUIRES more steel!

The Paradox:

- Decarbonization needs steel (wind, solar, EVs)

- But steel production emits 7% of global CO₂

- Solution: MUST green the steel, cannot reduce it

The China Challenge

China = 54% of Global Steel (1 Gt/year):

- 500+ blast furnaces (mostly coal)

- Emission intensity: 2.0 tons CO₂/ton steel (higher than global average)

- Problem: Overcapacity, low prices, slow to transition

China’s Green Steel Plans:

- Peak steel: 2030 (1.1 Gt/year)

- Green steel target: 30% by 2030 (330 Mt/year)

- H₂ investment: $50B+ committed

- But: Skepticism about pace (coal lobby strong)

Global Impact:

- If China doesn’t transition: 2 Gt CO₂/year locked in

- Carbon border adjustments (EU CBAM): Tariffs on high-carbon steel

- Opportunity: Western green steel captures market share

ACTIVITY 3: 30-Day Green Steel Investment Plan

Week 1: Research & Understand

Day 1-3: Steel Production Basics

- Watch: How steel is made (blast furnace vs DRI)

- Read: H₂ DRI technology explainers

- Understand: Why hydrogen eliminates CO₂

Day 4-5: Company Research

- ArcelorMittal: Read green steel strategy

- H2 Green Steel: Review company website, press releases

- Boston Metal: Understand MOE technology

Day 6-7: Market Analysis

- Track: Steel prices (LME, commodity exchanges)

- Monitor: Green steel premium (€100-200/ton currently)

- Research: EU CBAM impact timeline

Week 2: Portfolio Planning

Day 8-10: Allocation Decision

- Green steel target: ___% of portfolio (recommend 5-15%)

- Amount: €_____

- Split: ___% producers, ___% H₂ infrastructure, ___% equipment, ___% ore

Day 11-13: Risk Assessment

- Technology risk: H₂ DRI proven, MOE experimental

- Policy risk: Carbon pricing, subsidies (generally supportive)

- Market risk: Steel is cyclical (volatile commodity)

- Time horizon: 10+ years required (not quick flip)

Day 14: Build Watchlist

- Public stocks: MT, TKA, APD, VALE (at minimum)

- IPO alerts: H2 Green Steel, Boston Metal (2026-2028)

- News sources: SteelOrbis, World Steel Association

Week 3: Execute Initial Investment

Day 15-17: Open Accounts

- Brokerage with international access (for European stocks)

- Consider: Options for pre-IPO access (EquityZen, Forge for H2 Green Steel)

Day 18-20: First Purchases

- Start with 30-40% of target allocation

- Diversify: 3-5 stocks minimum

- Document: Cost basis, thesis for each

Day 21: Track & Monitor

- Set up: Google Finance or Yahoo portfolio tracker

- Alerts: Green steel news, H₂ pricing, policy changes

- Calendar: Quarterly earnings reviews

Week 4: Long-Term Strategy

Day 22-24: Private Market Research

- If accredited investor: H2 Green Steel secondary shares (platforms: Forge Global, EquityZen)

- Expected valuation: $10-20B at IPO (2026-2027)

- Current pre-IPO: $10-15B range

Day 25-27: Advocacy & Education

- Corporate: If employer uses steel, advocate for green steel procurement

- Political: Support carbon pricing, green steel subsidies

- Social: Share investment thesis, inspire others

Day 28-30: Commit Long-Term

- Review Activity 5 (commitment contract)

- Set: Annual portfolio rebalancing calendar

- Patience: This is 10-15 year play, not 1-year trade

Expected Results:

- Allocated: €_____ to green steel investments

- Expected return: 14-22%/year (diversified portfolio)

- 10-year value: €_____ → €_____

- Impact: Supporting 100,000-500,000 tons green steel capacity (per €10K invested)

ACTIVITY 4: Green Steel Investment Strategy (20 min)

Conservative Strategy (€100,000):

- 40% Established steel producers (MT, TKA): €40,000

- Low green steel % now, growing 2025-2035

- Return: 10-16%/year

- 30% H₂ infrastructure majors (APD, LIN): €30,000

- Diversified beyond steel, stable

- Return: 10-14%/year

- 20% Iron ore (VALE, BHP): €20,000

- Commodity exposure, dividend yield

- Return: 10-18%/year

- 10% Cash reserves: €10,000

Expected Return: 10-15%/year 10-year Value: €259,374-404,556 Risk: Low-moderate

Moderate Strategy (€100,000):

- 30% Public steel producers: €30,000

- 25% H₂ infrastructure (APD + PLUG): €25,000

- PLUG adds growth/volatility

- Return: 15-25%/year weighted

- 20% Pre-IPO (H2 Green Steel via secondary, if accredited): €20,000

- High growth potential

- Return: 25-40%/year

- 15% Equipment (Mitsubishi Heavy, diversified industrials): €15,000

- Return: 10-15%/year

- 10% Iron ore: €10,000

Expected Return: 16-24%/year 10-year Value: €438,633-827,847 Risk: Moderate

Aggressive Strategy (€100,000):

- 35% Pre-IPO green steel (H2 Green Steel, Boston Metal): €35,000

- If accredited investor

- Return: 30-60%/year potential (also high risk!)

- 25% High-growth H₂ (PLUG, Bloom Energy): €25,000

- Return: 25-45%/year

- 20% Public steel producers: €20,000

- Stability component

- Return: 12-18%/year

- 15% Early-stage green steel startups (via VC fund): €15,000

- Return: 40-80%/year (survivors)

- 5% Iron ore: €5,000

Expected Return: 27-50%/year (high variance) 10-year Value: €1,014,548-5,766,524 (survivor bias – many bets may fail) Risk: Very high

Rebalancing Rules:

- Quarterly: Review company progress (capacity additions, cost reductions)

- Sell: If green steel premium disappears faster than expected (competition)

- Buy more: If H₂ prices drop faster (improves economics)

- Diversify: Never >25% in single stock

The Technology Revolution: Beyond Hydrogen DRI

Hydrogen DRI (Current Leader)

HYBRIT (SSAB + Vattenfall + LKAB):

- Sweden, operational pilot 2021

- 1.3 Mt/year plant by 2026

- Process: 100% fossil-free

- Cost: On track for parity by 2030

H2 Green Steel:

- 5 Mt/year plant in Sweden (2026 start)

- Offtake: BMW, Mercedes, Scania signed

- €4.5B investment

- Largest green steel plant globally

Molten Oxide Electrolysis (Next-Gen)

Boston Metal:

- Electricity → molten iron oxide → pure iron

- No hydrogen needed!

- Zero carbon, zero water

- Energy efficiency: 30% better than H₂ DRI

- Timeline: Pilot now, commercial 2028-2030

Advantages:

- Simpler than H₂ (no H₂ production/storage)

- Can use any renewable electricity directly

- Byproducts: Oxygen (valuable!)

If Successful:

- Could leapfrog H₂ DRI

- Lower costs

- Faster scaling

Carbon Capture (Transitional)

Blast Furnace + CCS:

- Capture CO₂ from traditional blast furnace

- Store underground

- Reduction: 70-90% (not 100%)

Companies:

- ArcelorMittal: 4 Mt CO₂/year capture target (2030)

- Tata Steel: CCS pilot in Netherlands

Drawbacks:

- Still uses coal (resource depletion)

- CCS cost: $80-120/ton CO₂

- Not as clean as H₂ DRI or MOE

Role:

- Bridge technology (2025-2040)

- Keeps existing blast furnaces viable

- Buys time for H₂/MOE scale-up

ACTIVITY 5: Green Steel Investment Commitment (10 min)

I, ________________, commit to green steel investing principles.

My Understanding:

- Steel emissions: _____ Gt CO₂/year (7% of global)

- Green steel reduction: 95% fewer emissions

- Cost parity timeline: 2030-2035

- My conviction score: ___/10

My Investment Plan:

Phase 1 (Months 1-6): ☐ Allocate €_____ to green steel investments (___% of portfolio)

☐ Diversify: ___% producers, ___% H₂ infrastructure, ___% equipment, ___% ore

☐ Initial holdings: _____________ (list 3-5 stocks)

Phase 2 (Months 7-18): ☐ Scale to €_____ total allocation

☐ Add pre-IPO exposure (if accredited): €_____

☐ Monitor: Quarterly company updates, H₂ cost trends

Phase 3 (Year 2-10): ☐ Target allocation: % of portfolio in green steel

☐ Expected value (10 years): €__ → €_____

☐ Annual review: Rebalance based on technology/cost progress

My Expected Returns:

- Conservative estimate: ___%/year

- Base case: ___%/year

- Optimistic: ___%/year

- 10-year target value: €_____

My Risk Management:

- Maximum single stock: 20% of green steel allocation

- Stop-loss: -30% (if tech failure evident)

- Diversification: Minimum 5 holdings

- Time horizon: 10+ years (patient capital)

My Impact Goal:

- Green steel capacity supported: _____ Mt (per €10K invested ~50-100 Mt financed)

- CO₂ emissions avoided (lifetime): _____ Mt

- Supporting transition: Yes, this is long-term infrastructure play

Signature: ________________

Date: _____

Review Date: _____ (annually)

The Bottom Line: Green Steel Is Inevitable, Early Investors Win

Green steel (H₂ DRI + electric arc furnaces) cuts emissions 95% vs coal blast furnaces (1.8 → 0.1-0.3 tons CO₂/ton steel). Cost parity: 2030-2035 as green H₂ drops from $3-5/kg to $1.5-2.5/kg and carbon prices rise to $150-200/ton. Market size: $1.4T (70% of $2T steel market must transition by 2050). Current green steel: <1% of production = massive growth runway.

The investment case:

- Early-stage growth: Green steel 5 Mt (2025) → 500+ Mt (2040) = 100x scale-up

- Cost advantage: Green steel becomes cheaper than traditional by 2035

- Policy support: EU CBAM carbon tariffs force transition

- Demand certainty: Steel consumption rising 30-60% by 2050 (infrastructure needs)

Returns:

- Public steel producers transitioning: 12-18%/year

- H₂ infrastructure enabling: 10-16%/year

- Pre-IPO leaders (H2 Green Steel): 25-50%/year potential

- Equipment/ore: 10-20%/year

- Diversified portfolio: 14-22%/year expected

Your €50,000 in green steel:

- Conservative (10-15%): €129,687-202,278 in 10 years

- Moderate (16-24%): €219,317-413,793

- Aggressive (27-50%): €507,274-2,883,262 (high variance)

- Plus: Financing 250,000-500,000 tons green steel capacity

Green steel isn’t speculative—it’s engineering + economics. Steel must decarbonize (7% of emissions). Technology proven (H₂ DRI operational). Cost parity arriving (2030-2035). Early investors capture transition returns.

Invest in green steel. Decarbonize 7% of global emissions. Profit from the $1.4 trillion industrial transformation.

Welcome to green steel. Where heavy industry meets clean hydrogen. Where blast furnaces become electric arcs. Where coal becomes water vapor.

🏭💚⚡🔨