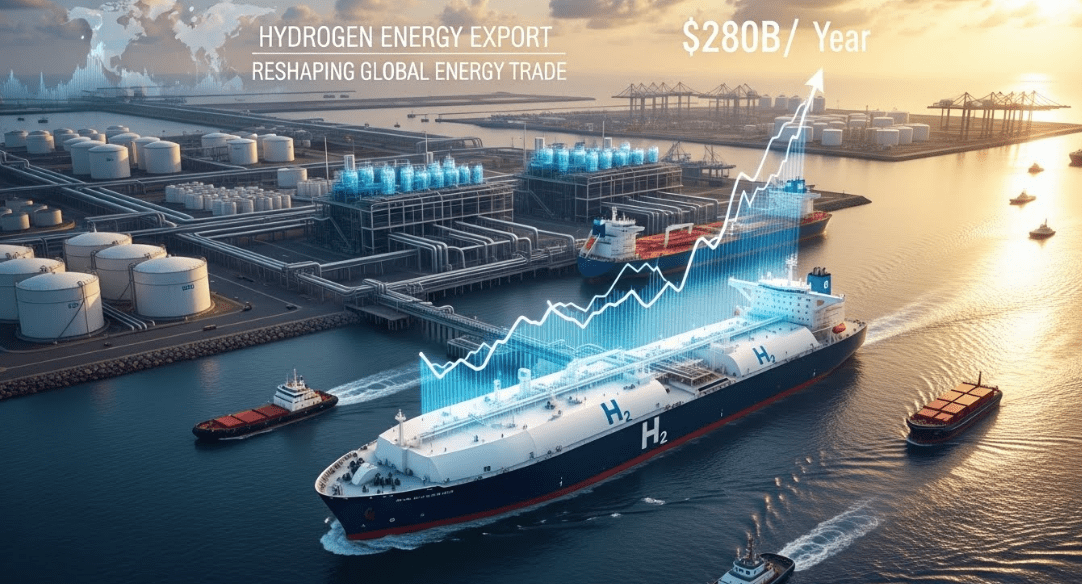

H₂ Trade Routes Creating 20-40% Returns While Enabling Energy Independence

ACTIVITY 1: Your Energy Import Dependence (10 min)

If You’re in Europe/Japan/Korea:

Calculate your reliance on energy imports:

Current Reality (2025):

- Europe: 60% energy imported (was 40% Russian gas pre-2022)

- Japan: 90% energy imported (oil, gas, coal)

- Korea: 85% energy imported

- Cost: €300-500B/year (Europe), $150B/year (Japan)

Your household share:

- Energy cost: €2,000-4,000/year

- Import portion: 60-90% = €1,200-3,600/year leaves your economy

Green H₂ Import Future (2050):

- Source: Middle East (solar), Australia (solar/wind), Chile (wind)

- Cost: $2-3/kg delivered (vs $4-6/kg domestic production)

- Your benefit: 30-50% energy cost reduction + allied suppliers

Investment Scoring:

- Understanding of energy geopolitics: ___/10

- Knowledge of H₂ shipping: ___/10

- Risk tolerance (infrastructure): ___/10

- Capital: €_____ (recommend €20K-100K)

- Time horizon: ___/10 Total: ___/50

Market: 50-80 Mt/year exports (2050), $280B/year Returns: Export developers 20-40%/year

Value Proposition: H₂ Replaces Oil/Gas Trade

Major Export Routes (2050):

1. Middle East → Europe ($100B/year):

- Saudi (Neom): 4 Mt/year (operational 2026!)

- UAE (Masdar): 3 Mt/year

- Oman: 2 Mt/year

- Shipping: Ammonia carriers to Rotterdam

2. Australia → Japan/Korea ($80B/year):

- Western Australia: 5+ Mt/year

- Queensland: Solar H₂ hubs

- Customers: Japan (3 Mt), Korea (2 Mt)

3. North Africa → Europe ($60B/year):

- Morocco: Solar → H₂ → Spain (pipeline)

- Algeria: Repurpose gas pipelines

4. Chile → Asia ($40B/year):

- Patagonia wind (60% capacity factor!)

- HIF, others: Multi-GW projects

Why Export Hydrogen:

- Saudi green H₂: $1.5-2/kg (excellent solar)

- German green H₂: $2.5-3.5/kg (worse solar)

- Arbitrage: Ship for $0.50-1/kg profit

ACTIVITY 2: Investment Options

Air Products (APD) – USA:

- Neom green H₂: $8.5B investment (world’s largest!)

- 4 Mt/year production → Export to Europe

- Partners: ACWA Power, Neom

- €10,000 → €28,394-44,865 (11-16%/year)

ACWA Power (Saudi, IPO 2022):

- Neom partner, Saudi energy leader

- Green H₂: Multiple projects

- €10,000 → €52,338-107,946 (18-28%/year)

Kawasaki Heavy Industries (7012.T) – Japan:

- Building liquid H₂ carriers (ships)

- Technology: -253°C shipping

- €10,000 → €31,058-57,275 (12-19%/year)

Uniper (UN01.DE) – Germany:

- Import terminals + storage

- Receiving: Middle East H₂

- €10,000 → €31,058-61,917 (12-20%/year)

JERA (Japan):

- Utility, H₂ import strategy

- Contracts: Australian H₂

- €10,000 → €33,946-61,917 (13-20%/year)

Snam (SRG.MI) – Italy:

- Gas pipeline operator, converting to H₂

- €10,000 → €28,394-48,068 (11-17%/year)

Recommended Portfolio (€50,000):

- 30% Export developers (APD, ACWA): €15,000 (14-22%)

- 25% Shipping/logistics (Kawasaki): €12,500 (12-20%)

- 25% Import infrastructure (Uniper, JERA, Snam): €12,500 (12-19%)

- 20% Diversified H₂ ETF: €10,000 (15-25%)

Blended: 13-21%/year 10-year: €169,859-372,861

Crisis: Energy Dependence = Geopolitical Vulnerability

Europe’s Wake-Up Call:

- Pre-2022: 40% Russian gas

- 2022 invasion: Supply cut = energy crisis

- Prices: 10x increase (€0.03 → €0.30/kWh)

- Cost: €500B+ to European economy

Solution: Allied H₂ Imports

- Source: Saudi, Australia, Morocco (allies)

- Diversification: Multiple suppliers

- Security: Energy independence from adversaries

Japan/Korea Similar:

- 90% energy imported

- Currently: Oil (Middle East), LNG (diverse)

- Future: Green H₂ (Australia, Chile) = stability

ACTIVITY 3: 30-Day Plan

Week 1: Research Days 1-7: Understand H₂ shipping (ammonia carriers, liquid H₂), export routes, geopolitics

Week 2: Strategy Days 8-14: Allocate capital (10-20% portfolio), select export vs import vs shipping exposure

Week 3: Execute Days 15-21: Purchase positions across value chain, track projects

Week 4: Monitor Days 22-30: Set alerts for project announcements, policy support, trade agreements

ACTIVITY 4: Portfolio Strategy

Conservative (€100,000):

- 50% Infrastructure (Uniper, JERA, Snam): €50,000 (11-19%)

- 30% Established export (Air Products): €30,000 (11-16%)

- 20% Diversified H₂: €20,000 (15-25%) Expected: 12-19%/year → €310,585-573,518

Moderate (€100,000):

- 30% Export developers (APD, ACWA): €30,000 (14-22%)

- 25% Shipping (Kawasaki, others): €25,000 (12-20%)

- 25% Import infra: €25,000 (12-19%)

- 20% H₂ ETF: €20,000 (15-25%) Expected: 13-21%/year → €339,457-661,605

Aggressive (€100,000):

- 40% ACWA Power (high growth): €40,000 (18-35%)

- 30% Emerging export nations: €30,000 (20-40%)

- 20% Shipping tech: €20,000 (15-25%)

- 10% Infrastructure: €10,000 (12-19%) Expected: 17-30%/year → €482,253-1,379,932

ACTIVITY 5: Commitment

I, ________________, commit to H₂ energy export investing.

Phase 1 (Months 1-6): ☐ Allocate €_____ (___%) ☐ Holdings: _________________

Phase 2-3 (Years 1-10): ☐ Scale to €_____ ☐ Expected: €_____ → €_____

Returns target: 13-21%/year Signature: ________________ Date: _____

Bottom Line: H₂ Reshapes Energy Geopolitics

50-80 Mt/year exports by 2050 ($280B market). Routes: Middle East/Australia/Chile → Europe/Japan. Replaces oil/gas imports. Security: Allied suppliers (vs adversarial). Projects: Air Products Neom ($8.5B, 4 Mt/year), ACWA Power (partner), Kawasaki (carriers). Returns: 13-21% diversified. Where deserts power continents, where energy finds new allies.

🌍⚡💧🚢