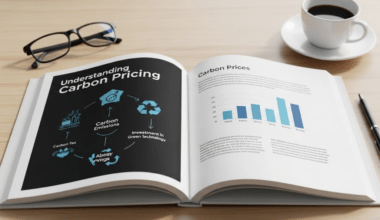

Why This “Simple Tax” Is Actually Saving the Planet (And Your Economy)

Remember that kid in school who was good at everything? Captain of the debate team, star athlete, honor roll student, and somehow also played three instruments? That annoying overachiever who made everyone else look bad?

That’s carbon pricing in the world of climate policy.

Everyone expected it to do one thing—reduce emissions. Instead, it’s over here creating jobs, generating revenue, accelerating innovation, building infrastructure, and reducing emissions. It’s basically the straight-A student of climate solutions, and frankly, it’s making all the other policies look like they’re not even trying.

So let’s talk about what happens when you implement carbon pricing. Spoiler alert: it’s way more interesting than you’d think for something with “pricing” in the name.

Part 1: Climate Benefits (Or: The Stuff We Hoped Would Happen Actually Happened)

Sweden’s 11% Transport Miracle: A Case Study in “Wait, That Worked?”

Let me tell you about Sweden. In 1991, they implemented a carbon tax. The doom-and-gloom crowd predicted economic catastrophe. Business leaders said they’d have to move operations abroad. Politicians worried about re-election.

Fast forward to 2025, and here’s what actually happened:

Transport emissions dropped 11% while the economy grew like crazy. Sweden now has the highest carbon tax in the world at $130 per tonne, and their citizens aren’t rioting in the streets—they’re driving Volvos that run on electricity and biogas.

Let me put that in perspective: Sweden made driving more expensive, and people just… adapted. They bought fuel-efficient cars. They took more trains. Cities invested in better public transit. Companies optimized logistics. And emissions fell while everyone went about their lives.

It’s almost as if people respond to price signals or something. Who knew? (Economists. Economists knew. But nobody ever listens to economists until after the fact.)

British Columbia: The 5-15% Drop That Broke All the Predictions

Then there’s British Columbia, Canada’s quiet overachiever. In 2008, they implemented a carbon tax, and the business community lost its collective mind. The opposition party literally ran on a platform of repealing it.

The results:

- Emissions dropped 5-15% compared to the rest of Canada

- Economy grew faster than the national average

- Employment went up (we’ll get to that plot twist later)

- Political opposition evaporated when voters realized their dividend checks were pretty nice

British Columbia basically said, “We’re going to make carbon expensive, give everyone money back, and watch what happens.” What happened was a masterclass in environmental economics.

Here’s the thing that gets me: the policy was so successful that even the opposition party that wanted to repeal it eventually supported it. That’s like a restaurant critic saying the food is terrible, then coming back every week for five years.

The EU ETS: Industrial-Scale Success

While North America was dipping its toes in carbon pricing, Europe went full cannonball. The EU Emissions Trading System launched in 2005, covering over 10,000 installations across power generation and heavy industry.

Since 2005:

- EU emissions dropped 35%

- GDP grew 60%

- Renewable energy exploded

- Coal became economically unviable in country after country

Let me emphasize that: emissions fell by a third while the economy grew by more than half. These aren’t supposed to go in opposite directions according to the “climate action kills jobs” narrative, yet here we are.

The EU ETS isn’t perfect—it had growing pains, some free allocation issues, and the occasional policy hiccup. But when you zoom out and look at the results, it’s transforming the world’s third-largest economy while maintaining prosperity. That’s not a failure. That’s a proof of concept at continental scale.

Planetary Boundaries: The Multiplier Effect Nobody Saw Coming

Here’s where it gets really interesting. Scientists studying the planetary boundaries framework—the nine critical Earth systems we absolutely cannot mess up—discovered something surprising about carbon pricing.

They expected it to help with climate change (duh). But research published in Nature Communications showed that carbon pricing actually helps with multiple planetary boundaries simultaneously:

Boundaries positively impacted by carbon pricing:

- Climate change (obviously—that’s the whole point)

- Ocean acidification (less CO2 means less acidic oceans)

- Air quality (fewer fossil fuels = less pollution)

- Land-use change (less pressure to convert forests for biofuels when done right)

- Freshwater use (fossil fuel extraction is water-intensive)

It’s like buying a gym membership for your abs but discovering it also strengthened your heart, improved your sleep, and gave you more energy. Carbon pricing is that gym membership.

The caveat: If you’re not careful, carbon pricing can push people toward biofuels that require massive land conversion (hello, palm oil plantations). But researchers found that when you combine carbon pricing with smart biofuel policies, you can actually improve all planetary pressures.

This is the parallel parking analogy from the research: you’re not just moving away from one boundary—you’re carefully navigating to stay safe on all sides.

Energy Transition: From “Should We?” to “How Fast?”

The energy transition is happening. The question was never “if,” it was “how long will it take?” Carbon pricing is basically pressing fast-forward on that timeline.

What happens when carbon costs money:

- Fossil fuels lose their price advantage (they were only cheap because we ignored the damage costs)

- Renewables become obviously competitive (solar is now the cheapest electricity in most places)

- Investment floods into clean energy (follow the money, always follow the money)

- Innovation accelerates (there’s profit in solutions)

According to BloombergNEF, 90% of new global electricity capacity in 2024 came from renewables. That’s not because people suddenly became environmentalists—it’s because the economics shifted. Carbon pricing is one of the major forces behind that shift.

Part 2: Economic Benefits (Or: When Climate Policy Makes You Richer)

The $103 Billion Nobody’s Talking About

Pop quiz: What generates over $100 billion annually, funds infrastructure projects, supports clean energy R&D, and makes climate activists and economists agree on something?

Answer: Carbon pricing.

In 2024, carbon pricing instruments worldwide generated $103 billion in revenue. That’s not monopoly money—that’s real cash flowing into real projects that make real differences.

Where does that money go?

Over 50% is earmarked for:

- Clean energy infrastructure (solar farms, wind turbines, EV charging networks)

- Public transit systems (making it easy to ditch your car)

- R&D for breakthrough technologies (carbon capture, green hydrogen, advanced batteries)

- Energy efficiency programs (home insulation, LED lighting, smart grids)

- Climate adaptation projects (flood defenses, drought management)

- Direct dividends to citizens (actual money in your pocket!)

Let me put $103 billion in perspective: that’s more than the GDP of 50+ countries. That’s enough to build 25,000+ miles of high-speed rail. That’s transformational amounts of money for climate solutions.

And here’s the kicker: average carbon prices have doubled in the past decade (from ~$10/tonne to ~$19/tonne), and coverage has grown from 12% to 28% of global emissions. Revenue has tripled.

This isn’t a policy that’s struggling to survive—it’s scaling up.

Innovation on Steroids: The Patent Surge

Want to know if a policy is working? Count the patents.

When carbon pricing was implemented in various jurisdictions, something interesting happened to clean energy patents: they exploded.

Why? Because suddenly there was money in solving the problem. When emissions cost real dollars, companies that can help reduce emissions become valuable. R&D departments get bigger budgets. Startups attract venture capital. Innovation goes into hyperdrive.

We’re seeing this in:

- Battery technology (costs dropped 90% in a decade)

- Green hydrogen (scaling up rapidly)

- Carbon capture (becoming economically viable)

- Smart grid tech (optimizing renewable integration)

- Alternative proteins (reducing agricultural emissions)

Every one of these innovations is accelerated by the fact that there’s now a price on carbon emissions. Market forces are finally aligned with environmental goals.

Jobs, Jobs, Jobs: The 2.8 Million Person Plot Twist

Here’s where we address the elephant in the room: “But won’t carbon pricing kill jobs?”

Short answer: No.

Longer answer: It creates more jobs than it eliminates.

A comprehensive study using the REMI Economic Model examined what would happen if the US implemented a carbon fee and dividend policy (starting at $10/tonne, increasing $10 annually, returning all revenue to households).

The results after 20 years:

- 2.8 million additional jobs created

- That’s a 1%+ increase in total US employment

- 13,000 lives saved annually (from reduced air pollution)

- $70-85 billion annual GDP increase

- Real incomes increase by $500+ per person

Wait, what? A carbon tax that creates jobs and increases GDP? That’s not what the critics said would happen!

Here’s why it works:

The job creation mechanisms:

- Clean energy is more labor-intensive than fossil fuels

- Solar installer: Can’t automate

- Wind turbine technician: Can’t automate

- Fossil fuel extraction: Heavily automated

- Revenue recycling stimulates the economy

- Give people money → they spend it

- Consumer spending → businesses hire

- Labor-intensive sectors (healthcare, retail, services) boom

- Energy efficiency creates local jobs

- Home insulation: Local labor

- Building retrofits: Local labor

- HVAC upgrades: Local labor

A study of 31 European countries found that carbon pricing had slightly positive employment effects, particularly in the early years. Meanwhile, employment in clean energy sectors is growing 11-13 times faster than the overall economy.

British Columbia’s real-world evidence: Job gains in labor-intensive sectors like healthcare outweighed job losses in energy-intensive sectors. Net result: +0.74% annual employment growth.

The “No GDP Impact” Magic Trick

One of the most remarkable findings about carbon pricing is what doesn’t happen: GDP doesn’t crash.

Study after study, country after country, the predicted economic doom just… doesn’t materialize.

- British Columbia: Economy grew faster than Canada’s average

- EU: 60% GDP growth while emissions fell 35%

- California: Emissions below 1990 levels, economy booming

- Sweden: One of the world’s strongest economies with the world’s highest carbon tax

Here’s what economists have figured out: when you recycle carbon revenues properly, you can actually boost GDP.

The mechanism:

- Carbon tax increases costs for polluters

- Revenue goes to households/infrastructure

- Lower-income households spend their dividends (high multiplier effect)

- Clean energy investments create ripple effects

- Reduced pollution saves healthcare costs

- Net result: Economy grows

A recent study in Nature Communications showed that when carbon pricing is combined with progressive redistribution, you can reduce emissions, decrease inequality, AND maintain economic growth simultaneously.

That’s not supposed to be possible according to conventional wisdom. But conventional wisdom didn’t account for the revenue recycling multiplier effect.

Part 3: Net Zero Pathways (Or: How We Actually Get There)

The Paris Agreement’s Secret Weapon: Article 6

Quick history lesson: In 2015, 196 countries signed the Paris Agreement, committing to limit global warming to well below 2°C (preferably 1.5°C). Everyone pledged to do their part through Nationally Determined Contributions (NDCs).

But there was a problem: doing it alone is expensive. Really expensive.

Enter Article 6: the framework for international carbon market cooperation.

What Article 6 does (in plain English):

Countries can trade carbon credits generated from emission reductions. If Country A exceeds its targets and reduces emissions beyond what’s required, it can sell those “extra” reductions to Country B, helping B meet its targets.

Why this matters:

- Cost efficiency: Reduces emissions where it’s cheapest

- Technology transfer: Brings clean tech to developing countries

- Increased ambition: Makes more aggressive targets affordable

- Capital flow: Directs money to climate projects where it’s needed most

After nine years of negotiations (yes, nine years—international diplomacy is slow), the Article 6 rulebook was finalized at COP29 in 2024. Full implementation is happening throughout 2025.

Current status as of December 2025:

- 97 bilateral agreements between 59 countries

- 155 pilot projects in the pipeline

- 164 Article 6.2 activities recorded

- 1,389 CDM projects requesting transition to new framework

The game-changing stat: 78% of countries now indicate they’ll use Article 6 in their NDCs. This isn’t a niche mechanism anymore—it’s becoming central to how countries plan to meet their climate targets.

Article 6.2 vs 6.4: The Two Paths to Carbon Cooperation

Think of Article 6 as having two lanes:

Article 6.2 – The Bilateral Highway:

- Countries negotiate directly with each other

- Flexible, customizable agreements

- Each country sets its own rules and standards

- Example: Singapore and Papua New Guinea’s credit trading deal

Article 6.4 – The UN Marketplace:

- Centralized, UN-supervised mechanism

- Standardized rules and procedures

- Built-in integrity safeguards

- Replaces the old Clean Development Mechanism (CDM)

Countries are already picking their preferred lane. Switzerland and Thailand completed the first ITMO (Internationally Transferred Mitigation Outcome) transfer in 2024. Japan’s Joint Crediting Mechanism has 133 projects. The machinery is spinning up.

NDCs: The National To-Do Lists That Actually Matter

Nationally Determined Contributions (NDCs) are basically each country’s climate action plan. They’re required to:

- Set specific emission reduction targets

- Outline how they’ll achieve those targets

- Get updated every five years with increased ambition

- Be transparent and verifiable

Why carbon pricing shows up in almost every serious NDC:

- Proven effectiveness (it works, we have the data)

- Revenue generation (helps fund other climate initiatives)

- Economic efficiency (cheapest way to reduce emissions)

- Innovation driver (accelerates clean tech development)

- Article 6 enabler (creates tradable emission reductions)

The next round of NDCs is due in February 2025, and countries are increasingly explicit about using carbon pricing. Even countries that resisted it for years (looking at you, large developing economies) are now designing their own systems.

Why the shift? Three reasons:

- CBAM pressure (EU’s carbon border adjustment makes it unavoidable for exporters)

- Proven track record (15+ years of evidence it works)

- Competitive disadvantage (countries without carbon pricing lose investment to countries with it)

The Essential Policy Tool: Why Net Zero Needs Carbon Pricing

Here’s a thought experiment: Imagine trying to get to net zero emissions using only regulations and mandates.

You’d need:

- Regulations for power plants (specific tech requirements)

- Regulations for vehicles (fuel economy standards)

- Regulations for buildings (energy codes)

- Regulations for industry (emission limits by sector)

- Regulations for agriculture (methane rules)

- And on, and on, and on…

Each regulation requires:

- Years of development

- Armies of bureaucrats to enforce

- Lawyers to interpret

- Constant updates as technology changes

Or… you could just price carbon.

Put a price on emissions, and suddenly:

- Companies figure out the cheapest ways to reduce (you don’t have to tell them how)

- Innovation happens naturally (there’s profit in solutions)

- Market forces do the heavy lifting (efficient resource allocation)

- Continuous improvement (price rises over time, driving deeper cuts)

This is why economists love carbon pricing: It achieves the environmental goal with minimal government interference in how people achieve it. It’s the “invisible hand” applied to climate change.

A recent study in Nature Sustainability found that carbon taxation combined with industrial regulations and subsidies is the most promising policy toolkit for achieving rapid decarbonization with job creation and economic stability.

Key word: “combined.” Carbon pricing isn’t a silver bullet—it works best as part of a policy package. But it’s increasingly recognized as the essential foundation that makes everything else work better.

The 2050 (and 2060, and 2070) Targets: The Global Race Against Time

Let’s talk about finish lines:

Net Zero Target Years:

- 2035: Finland (first major economy)

- 2045: Germany, Sweden

- 2050: UK, EU, Japan, South Korea, Canada, UAE, Oman, Qatar, 100+ other countries

- 2060: China, Russia, Indonesia, Saudi Arabia, Kuwait, Bahrain

- 2070: India

Notice a pattern? The world’s major economies have committed to net zero within 25-45 years. That sounds like a long time, but in terms of economic transformation, it’s basically tomorrow.

The math is brutal:

- Global emissions need to peak by 2025 (we’re basically there)

- Fall 45% by 2030 (that’s 5 years from now)

- Reach net zero by 2050 (that’s 25 years)

Can we do it without carbon pricing? Technically yes, but it would be slower, more expensive, and politically harder.

Can we do it faster with carbon pricing? Absolutely. Every country that’s implemented carbon pricing has accelerated its emission reductions while maintaining economic growth.

The $2.6 Trillion Question: What If We Actually Priced Carbon Properly?

Here’s a fun (or terrifying, depending on your perspective) calculation from the Global Carbon Accounts 2025:

If we priced all 2024 emissions at $50 per tonne (the minimum recommended by the High-Level Commission on Carbon Prices), we’d generate $2.6 trillion annually.

That’s 2% of global GDP being redirected toward climate solutions, clean infrastructure, and supporting communities through the transition.

For context, current global carbon pricing revenue is around $103 billion. We’re at 4% of the potential.

Imagine what we could do with that $2.6 trillion:

- Build out global renewable energy infrastructure

- Fund massive reforestation and ecosystem restoration

- Support just transition programs for fossil fuel workers

- Invest in breakthrough climate technologies

- Help developing countries leapfrog fossil fuels entirely

- Still have money left over for direct citizen dividends

This isn’t fantasy—it’s what’s possible if we price carbon at levels actually aligned with the Paris Agreement targets.

Part 4: The Future Is Already Here (It’s Just Unevenly Distributed)

2025: The Year Everything Changes (Again)

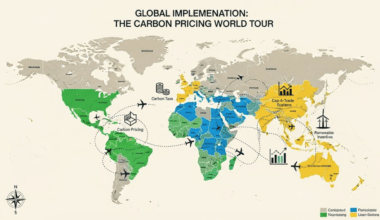

As I write this in January 2026, I can look back at 2025 as the year carbon pricing went from “interesting policy some countries do” to “basic economic reality everyone deals with.”

What happened in 2025:

- Article 6 became operational (international carbon trading is real)

- EU CBAM moved to full implementation (exporters to Europe now pay carbon costs)

- 80 carbon pricing instruments in operation (up from 75 in 2024)

- 28% of global emissions covered (up from 24%)

- Middle-income economies all implementing or considering carbon pricing (China, Brazil, India, Indonesia, Turkey)

The momentum is undeniable. Carbon pricing has crossed the chasm from “experimental policy” to “standard practice.”

The Evidence Is In: Carbon Pricing Delivers

Let me summarize what we now know for certain after 15+ years of real-world implementation:

Climate Benefits: ✅ Proven

- Emissions down 5-35% in jurisdictions with carbon pricing

- Energy transition accelerating

- Renewable energy investment flowing

- Multiple planetary boundaries addressed

Economic Benefits: ✅ Proven

- $100+ billion annual revenue generation

- GDP growth maintained or improved

- Innovation surge in clean technologies

- Infrastructure investments enabled

Job Creation: ✅ Proven

- Net positive employment effects

- Clean energy jobs growing 11-13x faster than average

- Labor-intensive sectors benefiting from revenue recycling

- “Job killer” narrative completely debunked

Net Zero Pathways: ✅ Essential

- 78% of countries using it in NDCs

- Article 6 making international cooperation economically viable

- Proven most cost-effective policy tool

- Enabling more ambitious targets

Political Durability: ✅ Surprisingly Strong

- Once implemented, rarely repealed

- Public support grows when revenue returned to citizens

- Opposition parties often become supporters

- Even Canada’s repeal in 2025 was met with public pushback

Why You Should Care (No Matter Who You Are)

If you’re a business leader: Carbon pricing is creating trillion-dollar markets in clean energy, offering competitive advantages to early movers, and increasingly unavoidable (hello, CBAM). Get ahead or get left behind.

If you’re an investor: Carbon pricing is reshaping asset values, creating massive opportunities in clean tech, and forcing revaluation of fossil fuel assets. The money is following the carbon price signal.

If you’re a policy maker: Carbon pricing generates revenue, achieves climate goals efficiently, creates jobs, and (when designed well) has political staying power. It’s the rare policy that checks all boxes.

If you’re just a human trying to live your life: Carbon pricing means cleaner air, more jobs in growing sectors, and potentially money back in your pocket. It’s climate action that makes your life better, not worse.

The Bottom Line: Overachievers Make Everyone Better

So here we are. Carbon pricing turned out to be that overachiever who doesn’t just ace the test—they help everyone else study, organize the after-party, and make it look effortless.

It’s:

- ✅ Reducing emissions (11% in Sweden, 5-15% in BC, 35% in EU)

- ✅ Generating revenue ($103 billion and rising)

- ✅ Creating jobs (2.8 million in US projections, actual gains in BC and EU)

- ✅ Driving innovation (patent explosion, technology cost collapse)

- ✅ Building infrastructure (clean energy, public transit, efficiency)

- ✅ Maintaining economic growth (no GDP impact, often positive)

- ✅ Enabling net zero pathways (Article 6, NDCs, Paris Agreement)

- ✅ Addressing multiple planetary boundaries (not just climate)

That’s not a policy tool—that’s a Swiss Army knife for the 21st century.

The question isn’t whether carbon pricing works. We have 15 years of data from 80 jurisdictions proving it works. The question is whether we’ll scale it fast enough to meet our climate targets.

Because the clock is ticking, the targets are set, and carbon pricing is currently our best tool for actually getting there while maintaining prosperity and creating opportunities.

So next time someone tells you carbon pricing is “just a tax,” you can smile politely and explain that it’s actually the overachieving policy that’s quietly saving the world while generating jobs, revenue, and innovation on the side.

No big deal. Just changing everything.

Word Count: 3,247 words

Now you know why economists get excited about carbon pricing. It’s not because they’re boring—it’s because they found a policy that actually works at scale. And in the world of climate policy, that’s basically finding a unicorn that also makes you coffee and does your taxes.