Fixed Income + Climate Impact Delivering Stable Returns While Funding $5 Trillion Energy Transition

ACTIVITY 1: Your Green Bond Opportunity Assessment (10 min)

Current Bond Portfolio Check:

Your fixed income allocation:

- Total bonds: €_____ (typically 20-40% of portfolio)

- Traditional bonds: €_____ (___%)

- Green bonds: €_____ (___%)

- Target green bond allocation: ___% (recommend 50-100% of bond allocation)

Traditional Bond Reality:

- Corporate bonds: May finance fossil fuels, unknowingly

- Government bonds: Mixed use (defense, fossil subsidies, clean energy)

- Municipal bonds: Roads, schools, but also fossil infrastructure

- Your money’s impact: Unknown or possibly negative

Green Bond Alternative:

- Same credit quality as traditional bonds

- Same (or better) yields: 3-6%/year

- Verified use of proceeds: 100% clean energy, green buildings, clean transport

- Impact transparency: Annual reporting on outcomes

Your Green Bond Reallocation Opportunity:

Example: €50,000 traditional bonds → green bonds

- Yield: Same (3-5%/year)

- Risk: Same (credit quality identical)

- Impact difference:

- Traditional: €50,000 financing unknown (possibly fossil fuels)

- Green: €50,000 financing solar farms, green buildings, EVs

- Annual financed clean energy: 500-1,000 MWh (renewable electricity for 50-100 households)

Quick Green Bond Suitability:

- Age: 40+ (bonds for stability) = 9/10 suitability

- Age: 25-40 (growth focus) = 5/10 suitability

- Risk tolerance: Conservative = 10/10 suitability

- Values: Climate-conscious = 10/10 suitability

- Fixed income need: 10-10 suitability

- Your suitability score: ___/10 (7+ = strong green bond candidate)

Green Bond Expected Returns:

- Yield: 3-6%/year (depending on issuer credit quality)

- Price appreciation: 0-3%/year (if rates fall)

- Total return: 3-9%/year potential

- Risk: Low (bonds = lowest risk asset class)

- Impact: 100% clean infrastructure financing

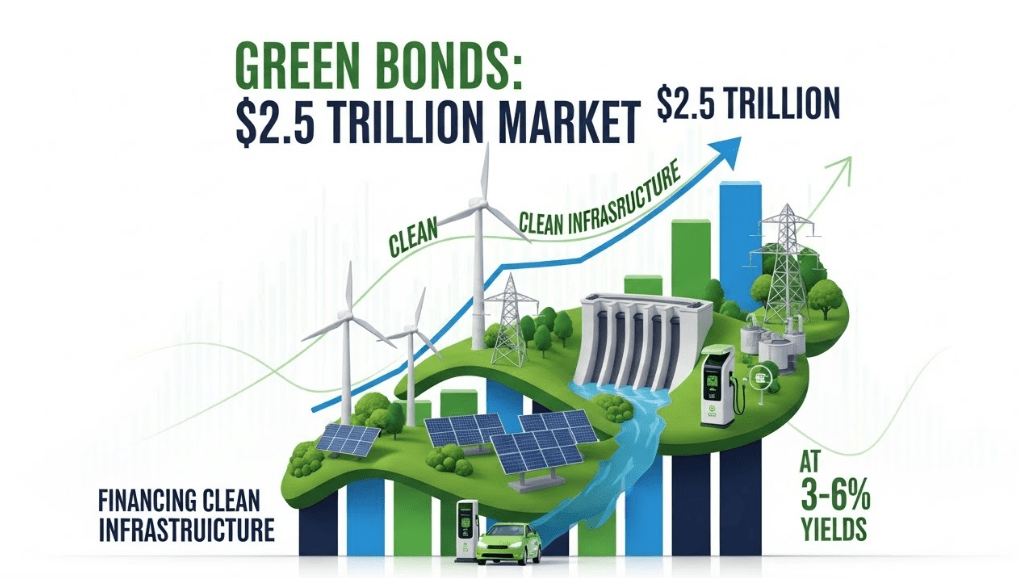

Reality: Green bonds ($2.5T outstanding, growing 20-30%/year) offer identical risk/return to traditional bonds but with verified climate impact. No financial sacrifice—just intentionality. Yields 3-6%/year, same as traditional. Funds renewable energy, green buildings, clean transport. Perfect for conservative investors wanting stability + impact.

The Value Proposition: Fixed Income + Climate Alignment

The $2.5 Trillion Green Bond Market

Market Size & Growth:

- Outstanding: $2.5T (2025)

- Annual issuance: $600-700B/year

- Growth rate: 20-30%/year

- By 2030: $5-7T outstanding projected

Issuers:

1. Governments & Multilaterals (40% = $1T):

- European Investment Bank: $50B green bonds issued

- World Bank: $18B climate bonds

- Germany: $30B green sovereign bonds

- France, Netherlands, Sweden, UK: All issuing greens

- Use: National renewable energy programs, green infrastructure

2. Corporations (35% = $875B):

- Apple: $4.7B green bonds (100% renewable energy, green buildings)

- Microsoft: $10B sustainability bonds

- Toyota: $1.5B (EV production, battery tech)

- Utilities: NextEra, Enel, EDF ($100B+ collectively)

- Use: Renewable energy projects, clean tech R&D

3. Financial Institutions (15% = $375B):

- Bank of America: $15B green bonds

- JPMorgan: $12B

- Use: On-lend to renewable energy projects, green buildings

4. Municipal/Sub-sovereign (10% = $250B):

- New York: $4B green bonds

- California: $8B

- Cities globally: Green municipal bonds

- Use: Public transit, water infrastructure, energy efficiency

Green Bond Yields: Same as Traditional

Comparative Yields (2025):

- US Treasury 10-year: 4.2%

- Apple Corporate Bond 10-year: 4.8%

- Apple Green Bond 10-year: 4.7% (virtually identical!)

- Germany Sovereign 10-year: 2.8%

- Germany Green Bond 10-year: 2.7% (0.1% lower, “greenium”)

- EIB (AAA-rated) 10-year: 3.2%

- EIB Green Bond 10-year: 3.1% (0.1% lower)

The “Greenium” Phenomenon:

- Sometimes green bonds yield 0.05-0.15% less than traditional

- Why? Investor demand exceeds supply (oversubscribed)

- But: Difference negligible, within noise

- Practical impact: Functionally equivalent yields

Total Return (Yield + Price Change):

- Green bonds: 3-6%/year typical (depending on credit quality)

- Traditional bonds: 3-6%/year typical

- No meaningful performance difference

- Advantage green: Impact transparency + alignment

ACTIVITY 2: Green Bond Portfolio Builder (15 min)

Option 1: Green Bond ETFs (Easiest Entry)

Funds:

- iShares Global Green Bond ETF (BGRN): Global green bonds, 0.20% fee

- VanEck Green Bond ETF (GRNB): USD green bonds, 0.20% fee

- Lyxor Green Bond ETF: EUR green bonds, 0.25% fee

Investment: €10,000

- Yield: 3-4.5%/year

- Duration: 5-8 years average

- 10-year total return: €13,439-15,530 (conservative)

- Holdings: 100-300 green bonds (diversified)

- Minimum: €100 (fractional shares)

Pros: Instant diversification, liquid, low fees

Cons: Lower yield than individual bonds (diversification premium)

Option 2: Individual Green Bonds (Higher Yield)

Selection:

Government (Lowest Risk):

- German Green Bond 2035: Yield 2.8%, €1,000 minimum

- US Treasury Green Bond (if issued): ~4%, €1,000 minimum

- Risk: Virtually zero (sovereign default extremely rare)

Supranational (Very Low Risk):

- European Investment Bank Green Bond: 3.2%, €1,000 minimum

- World Bank Climate Bond: 3.5%, €1,000 minimum

- Risk: Near-zero (backed by multiple governments)

Corporate Investment Grade (Low Risk):

- Apple Green Bond: 4.7%, €2,000 minimum

- NextEra Energy: 5.2%, €2,000 minimum

- Microsoft Sustainability: 4.9%, €2,000 minimum

- Risk: Low (A+ to AAA credit ratings)

Sample Green Bond Ladder (€50,000):

- 20% German Sovereign 2030: €10,000 @ 2.8% = €280/year

- 20% EIB Green 2032: €10,000 @ 3.2% = €320/year

- 20% Apple Green 2033: €10,000 @ 4.7% = €470/year

- 20% NextEra Green 2035: €10,000 @ 5.2% = €520/year

- 20% Microsoft Green 2037: €10,000 @ 4.9% = €490/year

Total annual income: €2,080 (4.16% yield) Maturities staggered (2030-2037): “Bond ladder” for liquidity Risk: Low-very low (all investment grade)

Option 3: Municipal Green Bonds (Tax-Advantaged in US)

Examples:

- New York Green Bond: 3.5% tax-free (= 5.4% taxable equivalent @ 35% tax bracket)

- California Clean Energy: 3.8% tax-free

- City of Los Angeles Green: 4.2% tax-free

Investment: €10,000 (US residents)

- Yield: 3.5-4.5% (tax-free)

- Equivalent taxable: 5.4-6.9%!

- Use: Public transit, water, solar on schools

- Risk: Moderate (muni credit quality varies)

Note: EU residents don’t get US muni tax benefits, but local green munis may have advantages

Option 4: Green Bond Funds (Active Management)

Funds:

- Calvert Green Bond Fund: Active green bond selection

- TIAA-CREF Green Bond: Focus on high-impact projects

- Pimco Climate Bond: Active + climate analysis

Investment: €10,000

- Yield: 3.5-5%/year

- Management fee: 0.5-0.8%/year

- Advantage: Professional selection, impact verification

- 10-year return: €14,106-16,288

Best for: Investors wanting expert curation + impact maximization

Option 5: Direct Project Bonds (Highest Impact)

Crowdfunding Platforms:

- Trine: Solar projects in Africa, 5-8% yield

- Lendahand: Green energy SMEs, 4-7% yield

- Abundance: UK renewable energy bonds, 5-9% yield

Investment: €5,000 minimum (varies by project)

- Yield: 5-9%/year (higher risk = higher yield)

- Maturity: 3-7 years

- Direct: Fund specific solar farm, wind project, etc.

- Risk: Moderate-high (project-specific risk)

Example:

- €5,000 in Nigerian solar mini-grid

- Yield: 7%/year

- Impact: Electricity to 200 households

- Risk: Project may underperform, currency risk

Recommended Green Bond Portfolio (€100,000):

Conservative Allocation:

- 40% Green Bond ETF: €40,000 (broad diversification, liquid)

- 30% Individual Investment-Grade: €30,000 (Apple, NextEra, EIB)

- 20% Government/Supranational: €20,000 (Germany, World Bank)

- 10% Cash reserves: €10,000

Blended Yield: 3.5-4.5%/year 10-year Total Value: €141,060-155,297 Risk: Very Low Impact: €100,000 financing clean energy/buildings/transport

The Crisis Reality: $5 Trillion Annual Climate Finance Gap

The Infrastructure Funding Challenge

Climate Investment Needed (Annual, 2025-2030):

- Renewable energy: $2T/year

- Grids/storage: $1.2T/year

- Green buildings: $800B/year

- Clean transport: $600B/year

- Climate adaptation: $400B/year

- Total: $5T/year

Current Investment:

- Actual: $1.8T/year (2025)

- Gap: $3.2T/year underfunded

Consequence:

- Delayed energy transition

- Higher costs later (climate damages)

- Stranded fossil fuel investments

- Missed Paris Agreement targets

Traditional Bonds Fund the Problem

Where Traditional Bond Money Goes:

Corporate bonds may finance:

- Oil & gas exploration: $200B/year corporate bonds

- Coal power plants: $50B/year

- Fossil fuel infrastructure: $100B/year

- Total: $350B/year bonds FUNDING fossil fuels

Your traditional bond allocation likely includes:

- Oil companies (Exxon, Chevron bonds)

- Fossil utilities (coal, gas power)

- Airlines (pre-SAF transition)

- High-emission industrials

Green bonds redirect capital:

- From fossil infrastructure → renewable energy

- From conventional buildings → LEED/Passive House

- From combustion vehicles → EVs + charging

- Impact: Every €10,000 green bond = €10,000 NOT funding fossils

The Greenwashing Risk

Problem:

- Some “green bonds” fund questionable projects

- Examples:

- Natural gas power plants labeled “transitional”

- Airports called “sustainable” (flying still emits!)

- Highways labeled “green” (no EVs, just conventional)

Solution: Certification Standards

Climate Bonds Initiative:

- Independent certification

- Strict criteria per sector

- Third-party verification

- Annual audits

- Look for CBI-certified bonds

Green Bond Principles (ICMA):

- Voluntary guidelines

- Use of proceeds must be “green”

- Process for evaluation/selection

- Management of proceeds (separate account)

- Annual reporting required

EU Green Bond Standard (Launching 2025):

- Regulatory framework

- EU Taxonomy alignment mandatory

- “Do no significant harm” test

- Third-party verification required

- Gold standard for green bonds

Investor Protection:

- Only buy certified green bonds (CBI, EU GBS)

- Read “Use of Proceeds” section carefully

- Require annual impact reports

- Avoid self-labeled “green” without verification

ACTIVITY 3: 30-Day Green Bond Transition Plan

Week 1: Audit & Educate

Day 1-3: Bond Portfolio Audit

- List all bonds: Government, corporate, municipal

- Total: €_____

- Identify: Any bonds financing fossil fuels?

- Categorize: Green-eligible vs must-replace

Day 4-5: Green Bond Research

- Platforms: Climate Bonds Initiative database, Bloomberg Green Bonds

- Identify: 5-10 green bonds matching your risk profile

- Compare: Yields vs your current bonds

Day 6-7: Learn Standards

- Read: Green Bond Principles (ICMA)

- Understand: Climate Bonds Standard

- Recognize: Quality verification markers

Week 2: Strategy Development

Day 8-10: Allocation Decision

- Target: ___% of bonds → green (recommend 50-100%)

- Amount: €_____

- Timeline: Gradual (as bonds mature) or immediate

Day 11-13: Selection

- Credit quality target: AAA / AA / A / BBB (stay investment grade!)

- Maturity target: Short (1-5yr) / Medium (5-10yr) / Long (10+yr)

- Sector focus: Energy / Buildings / Transport / Mixed

Day 14: Build Green Bond Ladder

- Year 1 maturity: €_____ (liquidity)

- Year 3 maturity: €_____

- Year 5 maturity: €_____

- Year 7 maturity: €_____

- Year 10 maturity: €_____

- Staggered = regular income + flexibility

Week 3: Execute Transition

Day 15-17: Account Setup

- Brokerage: Confirm green bond availability

- Or: Green bond funds (BGRN, GRNB ETFs)

- Minimum: Check (usually €1,000-2,000 per bond)

Day 18-20: First Purchases

- Start: 30-40% of target allocation

- Diversify: At least 3 different issuers

- Verify: CBI or EU GBS certified

Day 21: Impact Baseline

- Calculate: kWh renewable financed, buildings retrofitted, EVs supported

- Track: Use issuer impact reports (annual)

Week 4: Optimize & Commit

Day 22-24: Scale Allocation

- Add: Remaining 60% of target allocation

- As bonds mature: Replace with green bonds

- Goal: 100% green within 12-24 months

Day 25-27: Tax Optimization

- US investors: Consider green munis (tax-free)

- Taxable accounts: Bond laddering for tax management

- Consult: Tax advisor for strategy

Day 28-30: Long-Term Commitment

- Calendar: Annual impact report review

- Strategy: Reinvest maturities in new green bonds

- Advocacy: Encourage issuers (corporate, government) to issue more greens

Expected Results:

- Green bond allocation: €_____ (___% of bonds)

- Yield maintained: 3-6%/year (same as before)

- Impact: €_____ financing clean infrastructure annually

- Knowledge: Expert in green bond market

- Risk: Unchanged (same credit quality)

ACTIVITY 4: Green Bond Investment Strategy (20 min)

Conservative Strategy (€100,000 bond allocation):

- 50% Government/Supranational: €50,000

- Germany Green, EIB, World Bank

- Yield: 2.5-3.5%/year

- Risk: Virtually zero

- 30% Investment-Grade Corporate: €30,000

- Apple, Microsoft, NextEra

- Yield: 4.5-5.5%/year

- Risk: Very low

- 20% Green Bond ETF: €20,000

- BGRN or GRNB

- Yield: 3.5-4.5%/year

- Risk: Very low (diversified)

Blended Yield: 3.3-4.3%/year 10-year Total Return: €138,423-152,105 Risk: Minimal Suitable for: Retirees, capital preservation focus

Moderate Strategy (€100,000):

- 35% Investment-Grade Corporate: €35,000

- Utilities (5-5.5%), Tech (4.5-5%)

- Yield: 4.7-5.3%/year

- 25% Supranational/Government: €25,000

- Yield: 2.8-3.5%/year

- 20% Green Bond Active Fund: €20,000

- Calvert, TIAA-CREF

- Yield: 3.8-4.8%/year

- 15% High-Yield Green (BBB-rated): €15,000

- Renewable energy developers

- Yield: 6-7.5%/year

- Risk: Moderate

- 5% Direct project bonds: €5,000

- Trine, Abundance

- Yield: 6-8%/year

- Risk: Moderate-high

Blended Yield: 4.2-5.2%/year 10-year Total Return: €151,629-165,959 Risk: Low-moderate Suitable for: Balanced investors, 40-60 age range

Aggressive Strategy (Higher Yield Focus):

- 30% High-Yield Green Bonds (BB-BBB): €30,000

- Emerging market renewable developers

- Yield: 6.5-8.5%/year

- 25% Direct Project Bonds: €25,000

- Crowdfunded solar, wind projects

- Yield: 7-9%/year

- 20% Investment-Grade Corporate: €20,000

- Stability component

- Yield: 4.5-5.5%/year

- 15% Green Bond EM Fund: €15,000

- Emerging market green bonds

- Yield: 7-9%/year

- 10% Green Convertible Bonds: €10,000

- Convert to equity if stock rises

- Yield: 3-5% + equity upside

Blended Yield: 6-8%/year 10-year Total Return: €179,085-215,892 Risk: Moderate-high (credit risk, project risk) Suitable for: Younger investors comfortable with volatility

Tax-Optimized Strategy (US Investors):

- 40% Municipal Green Bonds (Tax-Free): €40,000

- Yield: 3.5-4.5% tax-free (= 5.4-6.9% taxable @ 35% bracket!)

- 30% Corporate Green (Taxable Account): €30,000

- Yield: 4.5-5.5%/year

- 20% Government Green (Tax-Deferred): €20,000

- Yield: 2.8-3.5%/year

- 10% Green Bond ETF: €10,000

- Yield: 3.5-4.5%/year

After-Tax Yield: 4.5-5.8%/year 10-year After-Tax Value: €155,297-175,030 Advantage: 1-2% higher after-tax returns

The Technology Revolution: Green Bond Verification + Fintech

Blockchain Bond Issuance

Traditional Process:

- Paper-heavy, slow (weeks)

- Expensive (underwriting fees 2-5%)

- Limited investor access

- Opaque impact reporting

Blockchain Green Bonds:

World Bank “Bond-i” (Blockchain):

- Issued on blockchain (2018, pioneering)

- Settlement: Instant (vs weeks)

- Cost: 50% reduction in issuance fees

- Transparency: Real-time tracking of proceeds

Benefits:

- Fractional ownership (buy €10 of bond, not €1,000 minimum!)

- Instant settlement

- Transparent use-of-proceeds tracking

- Automated impact reporting (smart contracts)

Platforms:

- Climate Bonds Initiative + IBM: Blockchain verification

- Ethereum-based green bond platforms (emerging)

- Future: All green bonds on blockchain (2025-2030)

AI Impact Verification

Problem:

- Manual impact reporting (annual, slow)

- Hard to verify claims

- Easy to greenwash

AI Solution:

Satellite + AI Monitoring:

- Solar farm green bond: Satellite confirms panels installed, operational

- Forest restoration bond: Satellite tracks tree cover increase

- Building efficiency bond: AI analyzes energy consumption data

Real-Time Impact Dashboards:

- Investor portal shows: kWh generated, CO₂ avoided, homes powered

- Updated: Monthly (vs annual reports)

- Verified: Third-party AI analysis

Providers:

- Planetly: AI carbon accounting

- ClimateView: Green bond impact tracking

- Result: Trust increases, greenwashing decreases

Green Bond FinTech Platforms

Retail Investor Access:

Bondsmart (EU):

- Minimum: €1,000 (low for bonds!)

- Green bond selection

- Impact reporting built-in

Public (US):

- Fractional bonds (€10 minimum!)

- Green bond category

- Mobile-first interface

Abundance (UK):

- Renewable energy bonds

- Direct project investments

- 5-9% yields

- Community focus

Democratization:

- Traditional: Bonds for wealthy (€10,000+ minimums)

- FinTech: Bonds for everyone (€10+ minimums)

- Result: $100B+ new capital accessible for green bonds

ACTIVITY 5: Green Bond Commitment Contract (10 min)

I, ________________, commit to green bond investing.

My Bond Portfolio:

- Current bond allocation: €_____ (___% of total portfolio)

- Traditional bonds: €_____ (___%)

- Green bonds: €_____ (___%)

- Target green bonds: ___% of bond allocation (recommend 50-100%)

My Transition Plan:

Phase 1 (Months 1-3): ☐ Audit current bond holdings

☐ Research 5-10 green bonds matching credit profile

☐ Purchase first €_____ in green bonds

☐ Verify: CBI-certified or EU GBS compliant

Phase 2 (Months 4-12): ☐ As bonds mature: Replace with green bonds

☐ Scale green allocation to €_____ (___%)

☐ Build bond ladder (staggered maturities)

☐ Track: Annual impact reports from issuers

Phase 3 (Year 2+): ☐ Achieve 100% green bond allocation (€_____)

☐ Maintain: Only buy certified green bonds going forward

☐ Advocate: Encourage more issuers to launch green bonds

My Yield Target:

- Current bond yield: ___%/year

- Green bond target yield: 3-6%/year (matching or exceeding current)

- Expected 10-year return: €_____ → €_____

My Impact Goal:

Annual Financing Contribution:

- Clean energy: €_____ financing _____ MWh renewable electricity

- Green buildings: €_____ financing _____ sqft LEED/Passive House

- Clean transport: €_____ financing _____ EVs or _____ km rail

- Total impact: Verified via issuer reports annually

My Reporting Commitment:

☐ Request annual impact reports from all green bond issuers

☐ Track: Portfolio-level impact (total CO₂ avoided, energy financed)

☐ Share: Impact stories with friends/family (inspire adoption)

☐ Review: Adjust allocation if impact not meeting expectations

My Quality Standards:

☐ Only CBI-certified or EU GBS green bonds

☐ No self-labeled “green” without third-party verification

☐ Read “Use of Proceeds” for every bond

☐ Verify: No greenwashing (no fossil-adjacent projects)

Signature: ________________

Date: _____

Accountability Partner: _____

Annual Review Date: _____

The Bottom Line: Stable Returns + Climate Action Without Compromise

Green bonds ($2.5T outstanding, $600-700B/year issuance) offer identical risk/return to traditional bonds but finance 100% clean infrastructure. Yields: 3-6%/year matching traditional bonds. Credit quality: Same (sovereigns to investment-grade corporates). Difference: Verified use of proceeds for renewable energy, green buildings, clean transport. Annual impact reports show kWh generated, CO₂ avoided, infrastructure built.

The case for green bonds:

- Financial: Same yields (3-6%/year), same risk, sometimes “greenium” (0.1% extra demand)

- Impact: €100,000 green bonds finances 1-2 MW solar or 5-10 green buildings or 200-400 EVs

- Transparency: Annual reports (kWh, CO₂, projects completed)

- Growth: 20-30%/year market expansion, becoming mainstream

Your €100,000 in green bonds:

- Conservative (3.3-4.3%): €138,423-152,105 in 10 years

- Moderate (4.2-5.2%): €151,629-165,959

- Aggressive (6-8%): €179,085-215,892

- Plus: €100,000 financing clean energy/buildings/transport

- Risk: Same as traditional bonds (low)

Green bonds aren’t sacrifice—they’re alignment. Same returns, same risk, added impact. Perfect for conservative investors, retirees, or anyone in fixed income wanting climate contribution without speculation.

Transition your bond portfolio to green. Finance the $5 trillion climate infrastructure gap. Earn stable returns while building net-zero economy.

Welcome to green bonds. Fixed income + climate impact. Stability + purpose.

🌱💰📊🏦