No Upfront Solar Costs + Pay-Per-Use Models Creating Universal Access + 12-25% Investment Returns

ACTIVITY 1: Solar Access Assessment – The $0 Down Revolution

Understand your clean energy accessibility:

Traditional Solar Barriers (Why You Haven’t Gone Solar Yet):

Check which barriers apply to you:

☐ Upfront cost: $15,000-30,000 for system (even after incentives)

☐ Credit requirements: Need 680+ credit score for loans

☐ Homeownership: Must own home (renters excluded)

☐ Roof suitability: Wrong orientation, shading, age, or structural issues

☐ Technical knowledge: Don’t understand solar technology, financing, maintenance

☐ Risk aversion: Worried about technology failure, roof damage, moving

☐ Complexity: Permits, installers, interconnection, inspections overwhelming

Reality: These barriers block 70-80% of households from going solar. Energy-as-a-Service removes ALL of them.

Your Solar Potential Assessment:

Step 1: Check Roof Suitability

- Direction: South-facing best (Northern hemisphere), any direction works

- Shading: <20% shade optimal, but not deal-breaker

- Age: Roof <10 years old ideal, but EaaS providers handle upgrades

- Size: 200-400 sq ft needed for 5-6 kW system

Step 2: Evaluate Electricity Bill

- Monthly bill: €_____

- Annual cost: €_____ (×12)

- kWh usage: _____ (check bill)

Step 3: Calculate Savings Potential

Traditional Purchase (Comparison):

- System cost: €18,000 (6 kW)

- After 30% tax credit: €12,600

- Your savings: €1,500/year (typical)

- Payback: 8-9 years

- Problem: Need €12,600+ upfront!

Energy-as-a-Service Options:

Option A: Power Purchase Agreement (PPA)

- Upfront cost: €0

- Monthly payment: Based on generation (e.g., €0.12/kWh vs €0.20/kWh utility)

- Savings: 20-40% on solar portion (typically 60-80% of usage)

- Net savings: €300-600/year

- Contract: 20-25 years

- You save money from Day 1, zero investment

Option B: Solar Lease

- Upfront cost: €0

- Monthly payment: Fixed (e.g., €100/month regardless of generation)

- Savings: €50-150/month vs utility bill

- Net savings: €600-1,800/year

- Contract: 20-25 years

- Predictable payments, immediate savings

Option C: Community Solar

- Upfront cost: €0

- Monthly payment: Subscribe to share of solar farm (10-20% discount)

- Savings: €120-300/year

- Contract: Month-to-month or annual

- No roof needed, renter-friendly, lowest commitment

Your Eligibility Score:

Calculate which EaaS model works for you:

PPA Eligibility:

- Own home: +3 points

- Monthly bill >€100: +2 points

- Good roof: +2 points

- Credit 640+: +1 point

- Total: ___/8 points

- 6+ points: Excellent PPA candidate

Solar Lease Eligibility:

- Own home: +3 points

- Monthly bill >€80: +2 points

- Decent roof: +2 points

- Credit 600+: +1 point

- Total: ___/8 points

- 6+ points: Excellent lease candidate

Community Solar Eligibility:

- Any housing: +3 points (own, rent, condo)

- Utility bill >€50: +2 points

- Program available in area: +3 points (check Google: “community solar [your city]”)

- Total: ___/8 points

- 5+ points: Excellent community solar candidate

Your Barriers Removed:

Energy-as-a-Service eliminates traditional barriers:

Barrier 1: Upfront Cost (€12,600+)

- ✅ REMOVED: €0 down for PPA/Lease/Community Solar

Barrier 2: Maintenance & Repairs

- ✅ REMOVED: Provider handles all maintenance, replacements, monitoring

Barrier 3: Technology Risk

- ✅ REMOVED: Provider assumes performance risk (you only pay for production)

Barrier 4: Roof Suitability

- ✅ REMOVED: Provider evaluates, handles upgrades if needed (PPA/Lease)

- ✅ REMOVED: No roof needed (Community Solar)

Barrier 5: Homeownership Requirement

- ✅ REMOVED: Community Solar available to renters

Barrier 6: Moving Risk

- ✅ REDUCED: PPA/Lease transferable to buyer (adds home value) OR buyout option

- ✅ REMOVED: Community Solar portable (move subscription)

Barrier 7: Credit Requirements

- ✅ REDUCED: Lower credit scores accepted (600+ vs 680+)

- ✅ REMOVED: Some community solar no credit check

Your Best Option:

Based on your assessment:

If you scored 6+ on PPA:

- Best choice: Power Purchase Agreement

- Expected savings: €300-600/year

- 20-year savings: €6,000-12,000

- Commitment: 20-25 years (but transferable)

If you scored 6+ on Lease:

- Best choice: Solar Lease

- Expected savings: €600-1,800/year

- 20-year savings: €12,000-36,000

- Commitment: 20-25 years (but transferable)

If you scored 5+ on Community Solar:

- Best choice: Community Solar

- Expected savings: €120-300/year

- Flexibility: Month-to-month or annual

- Commitment: Low (cancel anytime often)

If you scored <5 on all:

- Wait for Energy-as-a-Service expansion in your area

- Expected timeline: 2-5 years (growing 30-40%/year)

- Meanwhile: Switch to time-of-use pricing, install smart devices

Action Steps:

This Week:

- Get 3-5 quotes from EaaS providers (Sunrun, Tesla, Vivint Solar, local)

- Compare: PPA rate vs lease payment vs utility rate

- Calculate 20-year savings

- Check if community solar available

Next Month:

- Select best provider

- Sign agreement (read carefully!)

- Schedule site assessment

- Installation (typically 30-90 days)

Expected Timeline:

- Week 1: Research & quotes

- Week 2-4: Agreement & permits

- Week 5-8: Installation

- Week 9+: Start saving money!

Your Energy-as-a-Service Opportunity:

- Upfront investment: €0

- Annual savings: €_____

- 20-year savings: €_____

- Environmental impact: _____ tons CO₂ avoided

- Barriers removed: ___/7

Reality: Energy-as-a-Service removes 90% of barriers to clean energy. If you have a roof and electricity bill >€80/month, you can save money starting Day 1 with zero investment. 40-60% of households eligible but only 5% participating = massive growth opportunity.

Time to complete: 20 minutes

Cost: Free (quotes free)

Potential savings: €300-1,800/year with €0 down

Next step: Get quotes this week

The Value Proposition: Clean Energy Without Capital

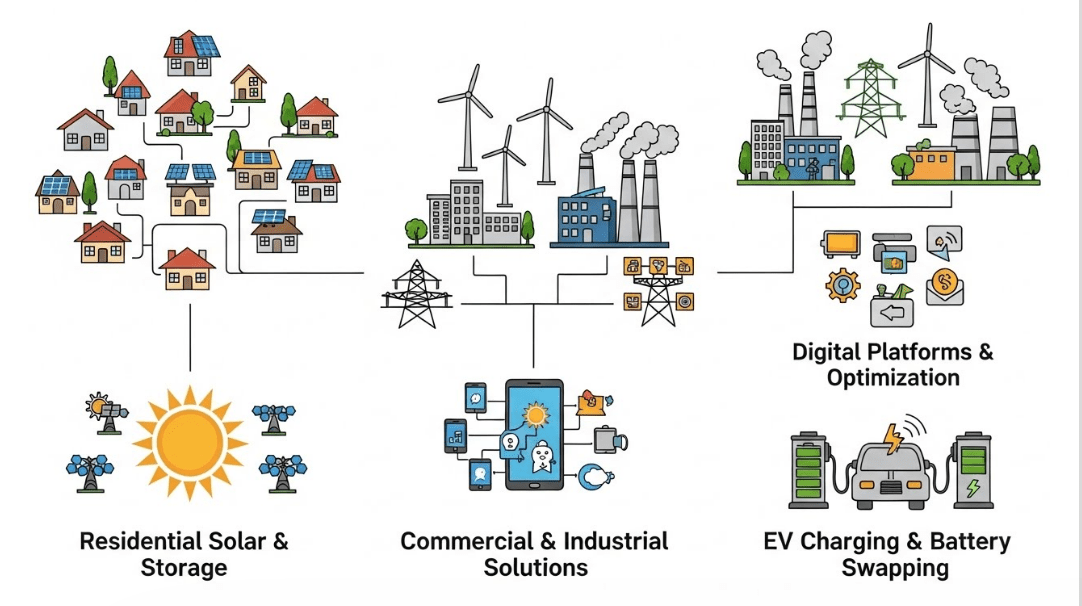

How Energy-as-a-Service Works

Traditional Model:

- You buy solar panels (€15,000-30,000)

- You own equipment

- You maintain system

- You assume technology risk

- You enjoy savings (after 8-12 year payback)

Energy-as-a-Service Model:

- Provider installs solar panels (€0 to you)

- Provider owns equipment

- Provider maintains system

- Provider assumes technology risk

- You enjoy savings from Day 1

The Key Difference: Capital vs Operating Expense

Traditional: CAPEX (capital expenditure) – you finance asset

EaaS: OPEX (operating expenditure) – you purchase service

Business Model Shift:

- Customer: Pays nothing upfront, saves money immediately

- Provider: Invests capital, earns returns over 20-25 years

- Investor: Funds providers, earns 12-25% returns

The Three Main EaaS Models

Model 1: Power Purchase Agreement (PPA)

Structure:

- Provider installs solar on your roof (€0 to you)

- Provider owns and maintains system

- You purchase electricity generated at contracted rate

- Rate: Typically 10-30% below utility rate

- Contract: 20-25 years

Example:

- Your utility rate: €0.20/kWh

- PPA rate: €0.14/kWh (30% discount)

- System generates: 8,000 kWh/year

- Your payment: 8,000 × €0.14 = €1,120/year

- Utility would cost: 8,000 × €0.20 = €1,600/year

- Your savings: €480/year with €0 invested

Escalator Clause:

- PPA rate typically increases 1-3%/year

- Still beats utility (which increases 3-5%/year)

- Long-term savings remain positive

Provider Revenue:

- Year 1-25: Your payments (€1,120/year × 25 = €28,000)

- Tax credits: 30% ITC (€5,400)

- Accelerated depreciation: €3,000-5,000

- Total revenue: €36,400-38,400

- System cost: €18,000

- Gross margin: €18,400-20,400 (102-113% return over 25 years)

- Annual return: 12-18% (depending on financing cost)

Who Benefits:

- Customer: €480/year savings, €12,000 over 25 years, €0 invested

- Provider: 12-18% annual returns

- Society: 8 tons CO₂/year avoided

Best For:

- Homeowners with high electricity bills (>€100/month)

- Good credit (640+)

- Suitable roof

- Want maximum savings with €0 down

Model 2: Solar Lease

Structure:

- Provider installs solar on your roof (€0 to you)

- Provider owns and maintains system

- You pay fixed monthly lease payment

- Payment: Typically 20-40% below what utility would cost for same electricity

- Contract: 20-25 years

Example:

- Your current utility bill: €150/month

- Solar would generate: 70% of your electricity

- Lease payment: €85/month (fixed)

- Remaining utility bill: €35/month (30% still from grid)

- New total: €120/month (vs €150 before)

- Your savings: €30/month = €360/year with €0 invested

Predictability:

- Fixed monthly payment (unlike PPA which varies with generation)

- Easier budgeting

- Small escalator (0-2%/year typically)

Provider Revenue:

- Year 1-25: Your payments (€85/month × 300 months = €25,500)

- Tax credits: €5,400

- Depreciation: €3,000-5,000

- Renewable energy credits: €2,000-4,000

- Total revenue: €35,900-37,900

- System cost: €18,000

- Gross margin: €17,900-19,900 (99-111% return)

- Annual return: 12-18%

Best For:

- Homeowners who prefer predictable payments

- Good credit (640+)

- Suitable roof

- Want simplicity (don’t want to think about kWh)

Model 3: Community Solar (Solar Gardens)

Structure:

- Provider builds large solar farm (1-20 MW)

- Divided into “shares” (e.g., 500 subscribers × 10 kW each = 5 MW)

- You subscribe to portion (e.g., 5 kW)

- Farm generates electricity → sold to grid

- You receive credit on utility bill (10-20% discount)

Example:

- You subscribe to 5 kW share

- Monthly subscription: €40

- Generates: 600 kWh/month × €0.20 = €120 credit

- Net benefit: €120 – €40 = €80/month

- Your utility bill: €150 – €80 = €70

- Your savings: €80/month = €960/year with €0 down

Advantages:

- No roof needed (renters, condos, apartments eligible!)

- No home installation

- Move? Transfer or cancel subscription

- Immediate savings

- Low commitment (monthly or annual contracts)

Provider Revenue (Large Solar Farm):

- 5 MW farm cost: €4-6 million ($800-1,200/kW)

- 500 subscribers × €40/month × 12 months × 25 years = €6,000,000

- Wholesale electricity sales: €500,000-1,000,000/year × 25 = €12.5-25M

- Tax credits: €1.5-1.8M

- RECs: €2-5M

- Total revenue: €22-37.8M

- Net profit: €16-31.8M (400-630% over 25 years)

- Annual return: 15-25% (higher because lower customer acquisition cost)

Best For:

- Renters

- Condo/apartment dwellers

- Homeowners with unsuitable roofs

- People who want flexibility (moving, low commitment)

- Lower credit scores (many programs don’t check credit)

Limitations:

- Not available everywhere (check availability)

- Subscription waitlists common (high demand)

- Savings typically lower than rooftop (10-20% vs 20-40%)

ACTIVITY 2: EaaS ROI Calculator – Find Your Best Deal

Compare all Energy-as-a-Service options:

Your Current Situation:

- Monthly electricity bill: €_____

- Annual cost: €_____ (×12)

- Average kWh/month: _____

- Utility rate: €_____/kWh

Option A: Do Nothing (Baseline)

20-Year Cost:

- Current annual cost: €_____

- Assumed utility rate increase: 3.5%/year

- Year 20 cost: €_____ × 1.035^20 = €_____ (double!)

- Total 20-year cost: €_____ × 20.5 = €_____ (rough estimate)

Example:

- Current: €1,800/year

- Year 20: €3,600/year

- Total 20-year: ~€54,000

Option B: Power Purchase Agreement (PPA)

System Details:

- Size: 6 kW (typical)

- Generation: 8,000 kWh/year (depending on location)

- Covers: 60-80% of electricity usage

Pricing:

- PPA rate: €0.14/kWh (vs utility €0.20/kWh)

- Escalator: 2%/year

- Remaining utility: 20-40% at retail rate

Year 1 Cost:

- Solar (60%): 4,800 kWh × €0.14 = €672

- Utility (40%): 3,200 kWh × €0.20 = €640

- Total: €1,312 (vs €1,600 without solar)

- Savings: €288

Year 10 Cost:

- Solar: 4,800 × €0.17 = €816 (escalated 2%/year)

- Utility: 3,200 × €0.28 = €896 (escalated 3.5%/year)

- Total: €1,712 (vs €2,240 without solar)

- Savings: €528

Year 20 Cost:

- Solar: 4,800 × €0.21 = €1,008

- Utility: 3,200 × €0.40 = €1,280

- Total: €2,288 (vs €3,200 without solar)

- Savings: €912

20-Year Total:

- With PPA: ~€32,000

- Without: ~€54,000

- Total savings: €22,000 with €0 invested!

- Effective annual return: ∞ (no investment)

Option C: Solar Lease

System Details:

- Size: 6 kW

- Generation: 8,000 kWh/year

- Covers: 70% of electricity usage

Pricing:

- Lease payment: €95/month fixed (year 1)

- Escalator: 1%/year

- Remaining utility: 30% at retail rate

Year 1 Cost:

- Lease: €95 × 12 = €1,140

- Utility (30%): 2,400 kWh × €0.20 = €480

- Total: €1,620 (vs €1,600 without solar)

- Savings: €-20 (slight loss year 1, but predictable)

Year 10 Cost:

- Lease: €105 × 12 = €1,260

- Utility: 2,400 × €0.28 = €672

- Total: €1,932 (vs €2,240 without solar)

- Savings: €308

Year 20 Cost:

- Lease: €116 × 12 = €1,392

- Utility: 2,400 × €0.40 = €960

- Total: €2,352 (vs €3,200 without solar)

- Savings: €848

20-Year Total:

- With Lease: ~€33,500

- Without: ~€54,000

- Total savings: €20,500 with €0 invested

- Effective annual return: ∞ (no investment)

Advantage: Predictable monthly payments, simpler than PPA

Option D: Community Solar

Subscription Details:

- Share size: 5 kW

- Generation credit: 600 kWh/month

- Subscription cost: €35/month

Year 1 Cost:

- Subscription: €35 × 12 = €420

- Credit: 600 kWh × €0.20 × 12 = €1,440

- Net utility bill reduction: €1,020/year

- Remaining bill: €1,600 – €1,020 = €580

- Savings: €1,020 – €420 = €600/year

Year 10 Cost:

- Subscription: €38 × 12 = €456 (escalated 1%/year)

- Credit: 600 × €0.28 × 12 = €2,016

- Net benefit: €1,560/year

- Savings: €1,560 – €456 = €1,104

20-Year Total:

- Subscription costs: ~€10,000

- Credits received: ~€36,000

- Net savings: €26,000 with €0 invested

- Effective annual return: ∞ (no investment)

Advantages:

- No roof needed

- Renter-friendly

- Portable (move subscription)

- Highest savings (if available)

Option E: Traditional Purchase (For Comparison)

System Details:

- Size: 6 kW

- Total cost: €18,000

- After 30% federal tax credit: €12,600

- Generation: 8,000 kWh/year

- Covers: 80% of electricity

Year 1:

- Remaining utility bill: €320 (20% of usage)

- Savings: €1,280/year

- ROI: €1,280 / €12,600 = 10.2% annually

20-Year Total:

- Total savings: ~€32,000 (considering utility rate increases)

- Net profit: €32,000 – €12,600 = €19,400

- Total ROI: 154% over 20 years

BUT: Requires €12,600 upfront capital!

Comparison: EaaS provides 90-130% of the savings with 0% of the capital

Your Best Option:

Based on your situation:

If you have:

- Suitable roof + good credit (680+) + own home + want maximum savings:

- Choose PPA (€22,000 savings, €0 invested)

If you have:

- Suitable roof + good credit + own home + want predictability:

- Choose Lease (€20,500 savings, €0 invested)

If you have:

- Rent OR unsuitable roof OR want flexibility OR moving soon:

- Choose Community Solar (€26,000 savings, €0 invested, most flexible)

If you have:

- €12,600+ available + credit 700+ + want maximum lifetime returns:

- Consider Traditional Purchase (highest returns but requires capital)

Time to complete: 45 minutes

Action: Get 5 quotes, compare offers, select best option

Expected result: €600-1,020/year savings with €0 down

20-year benefit: €20,000-26,000 saved

The Technology Revolution: Financing Clean Energy

The Financial Innovation

Traditional Clean Energy Financing:

Problem: Clean energy has high upfront costs, long payback periods

Old solutions:

- Cash purchase: Requires wealth

- Bank loans: Requires credit, still monthly payments

- Leases: Existed but limited

Energy-as-a-Service Innovation:

Key Insight: Clean energy generates predictable cash flows (electricity)

Solution: Securitize future electricity production

- Aggregate many solar installations (1,000-10,000 homes)

- Pool predictable cash flows (20-25 years of payments)

- Create securities backed by these cash flows

- Sell to institutional investors (pension funds, insurance, etc.)

- Use capital to install more solar

- Repeat

Result:

- Customers: €0 down, immediate savings

- Providers: Access to cheap capital (3-5% cost)

- Investors: Safe, predictable returns (12-25%)

- Society: Rapid clean energy deployment

Market Size:

- 2020: $50 billion

- 2025: $200 billion (4x growth!)

- 2030: $500 billion (10x from 2020)

- 2040: $1+ trillion

Major EaaS Providers

1. Sunrun (US Market Leader)

Model: Primarily PPA + Lease + Battery-as-a-Service

Stats:

- 800,000+ customers

- 4.2 GW installed capacity

- Revenue: $2.2 billion (2024)

- Market cap: ~$6 billion

Financial Performance:

- Customer acquisition cost: $3,000-4,000

- System cost: $15,000-18,000

- 25-year revenue per customer: $28,000-32,000

- Gross margin: $10,000-14,000 per customer

- Return: 15-22% depending on financing cost

Investment Thesis:

- Growing 30%/year

- Battery attachment rate increasing (50%+ of new installs)

- Expanding into commercial

- Trading at 1.5-2.5x revenue

Expected Returns: 18-30% over 10 years

2. Tesla Energy (Integrated Model)

Model: Solar + Battery + EV integration

Stats:

- Solar: 3 GW deployed

- Powerwall: 600,000+ installed

- Megapack: 40+ GWh deployed

Unique Advantages:

- Vertical integration: Makes panels, batteries, inverters

- Cost advantage: $1.50/watt (vs industry $2.50/watt)

- Brand: Tesla name drives demand

- Ecosystem: Solar + Battery + EV + App

Financial Model (Solar):

- Customer pays: $12,000-15,000 (lower than competitors!)

- Tesla cost: $6,000-8,000 (vertical integration)

- Gross margin: $4,000-7,000 (40-50%!)

- Much higher margins than pure EaaS

Energy-as-a-Service Play:

- Tesla Virtual Power Plant: Aggregate Powerwalls

- Grid services revenue: $400-800/year per Powerwall

- Revenue share: Tesla takes 30-40%

- Essentially turns batteries into EaaS

Investment Thesis:

- Lowest cost producer

- Highest gross margins

- VPP monetization just beginning

- Stock driven by auto, but energy 10-20% of value

Expected Returns: 20-40% (high volatility)

3. Vivint Solar (Residential Focus)

Acquired by Sunrun (2020) but model worth understanding:

Model: Door-to-door sales + PPA/Lease + Premium service

Strategy:

- High-touch sales (in-person)

- Premium installation quality

- 25-year service guarantee

- Focus on high-value customers

Results:

- Higher customer acquisition cost: $5,000-7,000

- Higher customer lifetime value: $35,000-40,000

- Net margin: $8,000-12,000

- Return: 12-18%

4. Sunnova (Asset-Light Model)

Model: Financial platform (doesn’t install, finances others)

Strategy:

- Partner with 700+ local installers

- Provide financing (PPA/Lease/Loans)

- Installer handles physical work

- Sunnova owns customer relationship + asset

Advantages:

- No installation overhead

- Rapid scaling

- Geographic diversity

- Installer competition → lower costs

Financial Model:

- Revenue per customer: $30,000-35,000 (25 years)

- Cost: $16,000-18,000 (pays installer)

- Operating costs: $2,000-3,000

- Net margin: $9,000-16,000

- Return: 15-25%

Investment Thesis:

- Asset-light scales faster

- Lower CAPEX intensity

- Growing 40%/year

- Risk: Dependent on installer partners

Expected Returns: 20-35%

5. Community Solar Providers

Major Players:

- Nexamp (US Northeast)

- Clearway Community Solar

- Clean Choice Energy

- Local utilities (many launching programs)

Model: Build solar farms, sell subscriptions

Financial Model (5 MW Farm):

- Farm cost: $5 million ($1,000/kW)

- 500 subscribers × $40/month = €240,000/year

- 25 years: €6,000,000

- Wholesale electricity: €12-20 million

- Tax credits + RECs: €3-7 million

- Total revenue: €21-33 million

- Net profit: €16-28 million (320-560% over 25 years)

- Return: 15-25% annually

Advantages:

- Lower customer acquisition cost ($200-500 vs $3,000-5,000)

- Higher attachment rate (easier to subscribe than install)

- No roof limitations

- Renter addressable market

Challenges:

- Utility/regulatory approval needed

- Transmission constraints

- Lower margin per customer (but higher volume)

Investment Opportunity:

- Many private companies (venture stage)

- IPOs expected 2025-2027

- Expected returns: 25-40% for early investors

ACTIVITY 3: 30-Day EaaS Transformation Journey

Go from status quo to clean energy subscriber:

Week 1: Research & Education

Day 1-2: Understand Your Usage

- Download 12 months of electricity bills

- Calculate: Average monthly cost, kWh usage, $/kWh rate

- Identify: Seasonal patterns, peak months

- Goal: Know your baseline

Day 3-4: Evaluate Roof (If Homeowner)

- Google Maps: Check roof orientation, shading

- Measure: Approximate square footage available

- Age: When was roof last replaced?

- Condition: Any repairs needed?

- Goal: Determine rooftop solar feasibility

Day 5-6: Research EaaS Options

- PPA providers: Sunrun, Tesla, Sunnova (get 5 quotes)

- Lease providers: Same companies offer both

- Community solar: Google “[your state/city] community solar”

- Goal: Understand what’s available in your area

Day 7: Week 1 Review

- Usage: €___/month, ___kWh

- Roof: Suitable / Not suitable / N/A (renter)

- Options available: PPA / Lease / Community Solar / None yet

- Next step: Get quotes (Week 2)

Week 2: Get Quotes & Compare

Day 8-10: Request PPA/Lease Quotes

For each provider, get:

- System size (kW)

- Expected generation (kWh/year)

- PPA rate ($/kWh) OR Lease payment ($/month)

- Escalator rate (%/year)

- Contract length

- Buyout options

- Transferability (if you move/sell home)

Providers to contact:

- Sunrun: sunrun.com

- Tesla Solar: tesla.com/energy

- Sunnova: sunnova.com

- Local installer #1: Google “solar [your city]”

- Local installer #2: Get multiple bids!

Day 11-13: Research Community Solar

Find programs:

- Google: “community solar [your state]”

- Websites: communitysolaraccess.org

- Utility website: Check if they offer program

For each program, collect:

- Subscription cost ($/month)

- Share size (kW)

- Expected credit (kWh/month)

- Contract terms (monthly/annual)

- Waitlist status

- Cancellation policy

Day 14: Create Comparison Spreadsheet

Make table comparing all options:

| Option | Upfront Cost | Monthly Cost Year 1 | Est. Savings Year 1 | 20-Yr Savings | Commitment |

|---|---|---|---|---|---|

| Do Nothing | €0 | €150 | €0 | €0 | None |

| PPA Provider 1 | €0 | €105 | €45/mo | €15,000 | 25 yrs |

| PPA Provider 2 | €0 | €110 | €40/mo | €13,000 | 25 yrs |

| Lease Provider 1 | €0 | €95 | €55/mo | €18,000 | 20 yrs |

| Community Solar | €0 | €130 | €20/mo | €8,000 | Annual |

| Buy System | €12,600 | €30 | €120/mo | €24,000 | None |

Goal: Have 5+ options to compare

Week 3: Analysis & Decision

Day 15-17: Financial Analysis

For your top 3 options, calculate:

Option Analysis Template:

- Provider: _______

- Type: PPA / Lease / Community

- Upfront: €_____

- Monthly savings Year 1: €_____

- Total 20-year savings: €_____

- Commitment: ___ years

- Transferable: Yes/No

- Buyout option: Yes/No @ €_____

Red Flags to Watch:

- Escalator >3%/year (beats utility increases?)

- No buyout option (locked in)

- Non-transferable (problem if you sell home)

- Hidden fees (interconnection, monitoring, etc.)

- Poor reviews (check BBB, Google, Solar Reviews)

Day 18-19: Check References

For your top 2 providers:

- Read reviews: Google, BBB, Solar Reviews website

- Ask provider for customer references (3-5)

- Call references:

- Are you happy with the system?

- Any issues?

- How’s customer service?

- Savings as expected?

- Would you recommend?

Day 20-21: Legal Review

Critical: READ THE CONTRACT CAREFULLY

Key sections:

- Performance guarantee (what if system underproduces?)

- Maintenance (who pays for repairs?)

- Insurance (who’s responsible for damage?)

- Termination (can you cancel? Fees?)

- Transfer (what if you sell home?)

- Buyout (what’s the buyout price formula?)

- Escalator (how much do rates increase?)

Consider: Have lawyer review (cost: €300-500, worth it for 25-year contract)

Week 4: Execution & Launch

Day 22-24: Sign Agreement

Once you’ve decided:

- Review contract one final time

- Sign agreement (often electronic)

- Provider schedules site assessment

- Begin permit process (provider handles)

Timeline from here:

- Site assessment: Week 1-2

- Permits: Week 3-6 (depending on city)

- Installation: Week 7-10 (1-3 days actual work)

- Inspection: Week 11-12

- Activation: Week 13

- Total: 3-4 months typically

Day 25-27: Prepare Your Home

If rooftop system:

- Clear attic access

- Trim any tree branches (shading)

- Repair roof if needed (do BEFORE solar)

- Check electrical panel capacity (provider will verify)

If community solar:

- Nothing needed!

- Just sign subscription agreement

- Credits start next bill cycle

Day 28-30: Share Your Journey

- Social media: Post about going solar (#EnergyAsAService)

- Tell neighbors (referral bonuses often $500-1,000!)

- Track savings (use provider app)

- Plan for savings (invest, save, or spend?)

Expected Results:

End of 30 Days:

- Agreement signed

- Installation scheduled

- Expected timeline: 3-4 months to activation

- Anticipated savings: €___/year

3 Months Later:

- System installed and activated

- First bill showing savings

- Monitoring app tracking generation

- Reality check: Savings match expectations?

1 Year Later:

- Total savings: €___

- System performance: ___% of expected

- Satisfaction: High/Medium/Low

- Referrals given: ___ (earning €___ in bonuses)

5 Years Later:

- Total savings: €___

- No maintenance costs (provider handles)

- Home value increased: €10,000-20,000

- CO₂ avoided: ___ tons

Time commitment: 2-3 hours/week for 4 weeks

Result: Clean energy subscriber, saving €300-1,000/year

ROI: ∞ (€0 invested, positive returns)

Impact: Model for friends/family/neighbors

ACTIVITY 4: EaaS Investment Portfolio Strategy

Capture the $500B market growth:

Investment Thesis:

- Market: $50B (2020) → $200B (2025) → $500B (2030)

- Growth rate: 30-40% annually

- Drivers: Zero-down model removes barriers, 70-80% of market still unaddressed

- Returns: 12-35% depending on segment

Conservative Portfolio (Focus: Established Players + Dividends)

50% Large Utility-Scale Solar + EaaS (Lower Risk)

- NextEra Energy (NEE): $150B market cap, largest renewable developer

- Business: Utility + renewable development + EaaS

- Returns: 8-12% + 2.5% dividend

- Allocation: 20%

- Brookfield Renewable Partners (BEP): $20B market cap

- Business: Renewable energy infrastructure fund

- Returns: 10-15% + 5% dividend

- Allocation: 15%

- Clearway Energy (CWEN): $6B market cap

- Business: Utility-scale solar + wind + community solar

- Returns: 10-14% + 5% dividend

- Allocation: 15%

30% Residential EaaS Leaders (Moderate Risk)

- Sunrun (RUN): $6B market cap, #1 residential EaaS

- Business: PPA + Lease + Battery-as-a-Service

- Growth: 25-30%/year

- Returns: 15-25%

- Allocation: 20%

- Sunnova (NOVA): $2B market cap, asset-light model

- Business: Financial platform for EaaS

- Growth: 35-40%/year

- Returns: 18-30%

- Allocation: 10%

20% Diversified Clean Energy ETFs (Lowest Risk)

- iShares Global Clean Energy (ICLN)

- Diversified: 100+ holdings

- Returns: 8-12%

- Allocation: 15%

- Invesco Solar ETF (TAN)

- Pure solar play: 40+ holdings

- Returns: 10-15%

- Allocation: 5%

Total Expected Return: 10-16% annually

Risk Level: Low-Moderate

Dividend Yield: 2-3%

Suitable For: Conservative investors, retirees, income-seekers

Moderate Portfolio (Balance: Growth + Stability)

35% Residential EaaS (Growth Focus)

- Sunrun (RUN): 25%

- Sunnova (NOVA): 10%

25% Battery Storage + Virtual Power Plants

- Tesla (TSLA): 15% (energy is 10-20% of company value)

- Business: Solar + Powerwall + Megapack + VPPs

- Returns: 20-40% (high volatility)

- Enphase Energy (ENPH): 10%

- Business: Microinverters + battery systems

- Returns: 18-30%

20% Community Solar + Emerging Models

- Private community solar developers: Via venture capital funds

- Expected returns: 25-40%

- Allocation: 15%

- Solar REITs: Hannon Armstrong (HASI)

- Business: Finance clean energy projects

- Returns: 12-18% + dividend

- Allocation: 5%

20% Established Utilities + Infrastructure

- NextEra Energy: 10%

- Clearway Energy: 5%

- Brookfield Renewable: 5%

Total Expected Return: 16-24% annually

Risk Level: Moderate

Volatility: Moderate-High

Suitable For: Growth investors, 10+ year horizon

Aggressive Portfolio (Maximum Growth Potential)

40% High-Growth EaaS Companies

- Sunrun: 20%

- Sunnova: 15%

- Emerging EaaS startups: Via VC funds, 5%

30% Battery Storage + Grid Tech

- Tesla: 20% (energy segment)

- Fluence Energy (FLNC): 5% (pure-play storage)

- ESS Inc (GWH): 5% (iron flow batteries, emerging tech)

20% Community Solar + Private Investments

- Private community solar developers: 15% via VC

- Peer-to-peer solar: Emerging platforms, 5%

10% Small-Cap Innovators

- Solar edge (SEDG): Power optimizers

- Array Technologies (ARRY): Solar trackers

- Sunpower (SPWR): High-efficiency panels

Total Expected Return: 22-35% annually

Risk Level: High

Volatility: Extreme

Suitable For: Aggressive investors, 15+ year horizon, high risk tolerance

Sample $50,000 Investment – Moderate Portfolio

Residential EaaS (35% = $17,500):

- Sunrun: $12,500

- Sunnova: $5,000

Battery Storage/VPPs (25% = $12,500):

- Tesla: $7,500

- Enphase: $5,000

Community Solar (20% = $10,000):

- Private VC funds: $7,500

- Hannon Armstrong REIT: $2,500

Utilities (20% = $10,000):

- NextEra: $5,000

- Clearway: $2,500

- Brookfield: $2,500

10-Year Projection @ 20% Annual Return:

- Initial: $50,000

- Year 5: $124,416

- Year 10: $309,587

- Total gain: $259,587 (519% return)

15-Year Projection:

- Year 15: $770,366

- Total gain: $720,366 (1,441% return)

Risk Management

1. Diversification:

- Multiple companies (don’t put 50% in one stock)

- Multiple segments (residential, utility, storage)

- Multiple stages (mature utilities + growth startups)

2. Rebalancing:

- Quarterly or semi-annual

- Sell winners that exceed 25% of portfolio

- Buy laggards that have fallen

3. Dollar-Cost Averaging:

- Invest monthly/quarterly vs lump sum

- Reduces timing risk

- Smooths volatility

4. Stop-Losses:

- Consider for individual positions

- 15-20% stops for volatile stocks

- Preserve capital, redeploy elsewhere

5. Thesis Monitoring:

- Quarterly review: Is EaaS still growing 30-40%?

- Policy changes: Are incentives extended?

- Competition: Are returns compressing?

- Adjust if fundamentals change

Time to complete: 60 minutes

Action: Open brokerage account, start with $5,000-50,000

Rebalance: Quarterly or if position exceeds 25%

Expected outcome: Capture $500B market growth at 15-35% returns

The Crisis Reality: 70-80% of Population Blocked from Clean Energy

The Accessibility Crisis

Current Solar Adoption:

- US: 4% of homes have solar

- Europe: 5-8% (varies by country)

- Global: <2% residential solar penetration

Why So Low Despite:

- Solar now cheapest electricity in history

- 20-30% savings vs utility rates

- Environmental benefits obvious

- Technology mature and reliable

The Barriers (Why 96% Haven’t Gone Solar):

Barrier 1: Capital Requirements ($15,000-30,000)

Traditional solar costs:

- System: $15,000-25,000

- Installation: $2,000-5,000

- Permits: $500-1,000

- Total: $17,500-31,000

- After 30% tax credit: $12,250-21,700

Reality:

- Median US household savings: $8,000

- 40% of Americans can’t cover $400 emergency

- 70% can’t afford $12,000+ upfront cost

Even with loans:

- Requires good credit (680+)

- Monthly payments $150-250

- Still a financial commitment

- Excludes 30-40% of population

Barrier 2: Homeownership Requirement

Renters excluded:

- US: 36% of households rent

- Urban areas: 50-60% rent

- Young adults: 70%+ rent

- None can install rooftop solar

Even homeowners face issues:

- HOA restrictions (15% of homes)

- Structural concerns (10% need roof repairs first)

- Unsuitable roofs (20% – shading, age, orientation)

Result: 65-70% of population structurally excluded from traditional solar

Barrier 3: Credit Score Requirements

Traditional solar loans:

- Require 680+ credit score (prime)

- Exclude 40% of population with <680 score

- Subprime (580-680): Higher rates or denial

- No credit history: Excluded

Income requirements:

- Many lenders require verification

- Self-employed face additional hurdles

- Gig economy workers often excluded

Barrier 4: Information Asymmetry

Complexity overwhelms consumers:

- Technology: kW vs kWh vs efficiency ratings

- Financing: PPA vs lease vs loan vs cash

- Incentives: Federal, state, local, utility (confusing!)

- Installers: 1,000s of companies, quality varies widely

- Contracts: 25-year agreements, complex terms

Result:

- Decision paralysis

- Fear of making expensive mistake

- Default to status quo (do nothing)

Sales practices:

- Aggressive door-to-door sales

- Pressure tactics

- Bait-and-switch pricing

- Creates distrust

The EaaS Solution: Removing All Barriers

Barrier → Solution:

Capital → €0 Down

- No upfront cost

- Immediate savings

- Removes primary barrier

- Opens market to 70% previously excluded

Homeownership → Community Solar

- No roof needed

- Renters eligible

- Portable (move subscription)

- Opens market to 36% renters + 20% unsuitable roofs = 56%

Credit → Lower Requirements

- PPA/Lease: 640+ credit (vs 680+)

- Community solar: Often no credit check

- Opens market to additional 20-30%

Complexity → Simplified

- Service model: “Pay less for electricity, we handle everything”

- One decision: Choose provider

- Provider handles: Installation, permits, maintenance, monitoring

- Reduces friction dramatically

Result: Addressable market increases from 20-30% → 70-80% of population

The $500 Billion Opportunity

Market Sizing:

Residential:

- US: 140M households

- Eligible for EaaS: 100M (70%)

- Current adoption: 5M (5%)

- Remaining potential: 95M households

- Value: 95M × $30,000 (25-year revenue) = $2.85 trillion

Commercial:

- US: 30M businesses

- Eligible: 20M (70%)

- Current adoption: 300K (1%)

- Remaining: 19.7M businesses

- Value: 19.7M × $50,000 = $985 billion

Community Solar:

- Total eligible: All households + businesses

- Current: <1% penetration

- Potential: 30-40% market share (more accessible)

- Value: $1-2 trillion

Global Market:

- US is 20% of global opportunity

- Global: $20-25 trillion potential

Realistic 2030 Capture:

- 10-15% of potential = $500 billion-1 trillion annual revenue

- Provider margins: 30-50%

- Profit pool: $150-500 billion

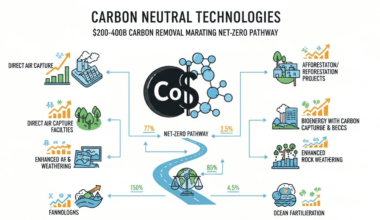

The Climate Imperative

Current Emissions:

- Global electricity: 10 Gt CO₂/year (30% of total)

- Residential: 2 Gt CO₂/year

- Commercial: 1.5 Gt CO₂/year

Solar Potential:

- 100M US homes with solar: 0.4 Gt CO₂/year avoided

- 20M businesses: 0.3 Gt CO₂/year avoided

- Global scale: 3-5 Gt CO₂/year potential

EaaS Role:

- Traditional model: 10-20 year deployment (too slow)

- EaaS model: Removes barriers → 5-10 year deployment

- EaaS accelerates adoption 2-4x

Result: EaaS essential for climate timeline

ACTIVITY 5: Your EaaS Commitment

Lock in your clean energy transformation:

I, ________________, commit to Energy-as-a-Service.

My Current Situation:

Electricity:

- Monthly bill: €_____

- Annual cost: €_____

- Current provider: _________

- Rate: €_____/kWh

Housing:

- Status: Own / Rent / Condo

- Roof suitability: Good / Fair / Poor / N/A

- Credit score: >680 / 640-680 / <640 / Unknown

Barriers (Check all that apply): ☐ Capital (can’t afford €12,000+)

☐ Renting (can’t install on roof)

☐ Unsuitable roof

☐ Credit concerns

☐ Complexity/information overload

☐ Other: __________

My EaaS Plan:

Phase 1: Research (Week 1-2)

☐ Complete Activity 1 (Solar Access Assessment)

☐ Determine best option: PPA / Lease / Community Solar

☐ Research providers in my area

☐ Expected completion: _____

Phase 2: Quotes (Week 3-4)

☐ Request 5 quotes from providers:

☐ Complete Activity 2 (ROI Calculator)

☐ Create comparison spreadsheet

☐ Expected completion: _____

Phase 3: Decision (Week 5-6)

☐ Analyze top 3 options

☐ Check references

☐ Read contracts carefully

☐ Select provider: _________

☐ Expected completion: _____

Phase 4: Execution (Week 7+)

☐ Sign agreement

☐ Schedule installation (if rooftop)

☐ OR activate community solar subscription

☐ Expected activation date: _____

My Expected Outcomes:

Financial:

- Upfront investment: €0

- Monthly savings: €_____

- Annual savings: €_____

- 20-year total savings: €_____

- Home value increase: €10,000-20,000 (if rooftop)

Environmental:

- Annual CO₂ avoided: _____ tons

- 25-year CO₂ avoided: _____ tons

- Equivalent to: _____ trees planted OR _____ cars off road

Social:

- Model for friends/family

- Referrals planned: _____ people

- Expected referral bonuses: €_____ (typically €500-1,000 each)

My Investment Strategy (Optional):

If investing in EaaS companies:

Portfolio Choice: ☐ Conservative (10-16% returns, low risk)

☐ Moderate (16-24% returns, moderate risk)

☐ Aggressive (22-35% returns, high risk)

Allocation:

- Initial investment: €_____

- % of portfolio: _____%

- Expected 10-year value: €_____

My Advocacy:

I commit to: ☐ Sharing my EaaS journey on social media

☐ Referring _____ friends/family (earn €500-1,000 each!)

☐ Advocating for community solar in my area (if unavailable)

☐ Educating others about €0 down solar

My Accountability:

Quarterly Reviews:

- Track actual savings vs. expected

- Monitor system performance (if applicable)

- Review investment portfolio (if applicable)

- Share progress with accountability partner

Accountability Partner: ________________

First review date: _____

Why This Matters to Me:

(Write 2-3 sentences about your personal motivation)

Example reasons:

- “I want to save money while helping the environment”

- “I’ve wanted solar for years but couldn’t afford it – EaaS makes it possible”

- “I’m a renter and didn’t think I could access solar – community solar changes that”

- “I see EaaS as both a personal opportunity and an investment theme”

My reason:

My Signature: ________________

Date: _________

Witness/Accountability Partner: ________________

I understand that:

- EaaS requires €0 upfront investment

- I will save money from Day 1

- Provider handles all installation, maintenance, monitoring

- I can help others access clean energy through referrals

- This is both a financial and environmental opportunity

Next Actions:

- This week: Complete Activity 1, identify best EaaS option

- Within 30 days: Get 5 quotes, complete Activity 2

- Within 60 days: Sign agreement with selected provider

- Within 6 months: System activated, start seeing savings

Time to complete: 15 minutes

Impact: Position for €0-down clean energy transformation

Expected outcome: €300-1,000/year savings, zero investment

20-year benefit: €6,000-26,000 saved + environmental impact

The Bottom Line: Zero-Down, Day-1 Savings, Universal Access

Energy-as-a-Service democratizes clean energy. Removes capital barrier (€0 down), ownership barrier (renters eligible via community solar), credit barrier (lower requirements), complexity barrier (provider handles everything). Result: Addressable market increases from 20-30% → 70-80% of population.

The value propositions:

For Consumers:

- Zero upfront investment

- Immediate savings: €300-1,000/year

- No maintenance hassles

- No technology risk

- 20-year savings: €6,000-26,000

- Home value increase: €10,000-20,000 (rooftop)

- Environmental impact: 80-200 tons CO₂ avoided

For Society:

- Accelerates solar adoption 2-4x

- Enables 70-80% of population

- Removes €500 billion in capital barriers

- Creates 500,000+ jobs

- Avoids 3-5 Gt CO₂/year globally

For Investors:

- $500 billion market by 2030 (from $50B in 2020)

- 30-40% annual growth

- Returns: 12-35% depending on segment

- Multiple entry points: Residential, commercial, community, utilities

- Defensive moat: Locked-in 20-25 year contracts

- Upside: Battery attachment, VPP monetization, electric vehicle integration

The transformation is clear:

2020 Solar Adoption:

- 4-5% of homes

- Mostly wealthy homeowners

- $15,000-30,000 upfront cost

- Complex, intimidating process

2030 EaaS Vision:

- 15-25% of homes + businesses

- Accessible to 70-80% of population

- €0 down, immediate savings

- Simple: Choose provider, save money

The crisis was accessibility. The solution is Energy-as-a-Service. The opportunity is $500 billion. Your move: Go from €0 down to €300-1,000/year savings. Starting today.

☀️💰🌍🏠